Question: Problem 5 Answer the following questions: a. Consider the classical Markowitz model. Assume Rf = 0.005 and n = 5 stocks. The optimal portfolio (point

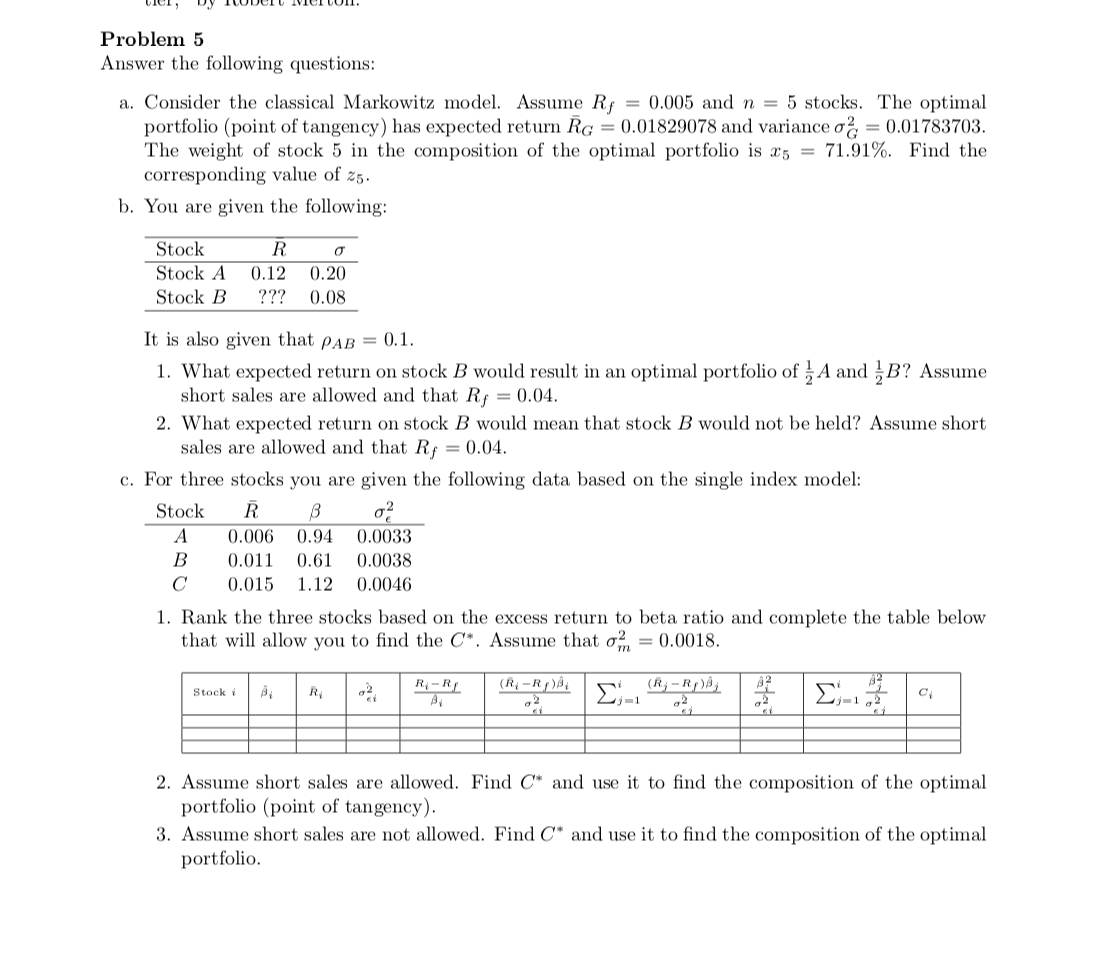

Problem 5 Answer the following questions: a. Consider the classical Markowitz model. Assume Rf = 0.005 and n = 5 stocks. The optimal portfolio (point of tangency) has expected return Rg = 0.01829078 and variance og = 0.01783703. The weight of stock 5 in the composition of the optimal portfolio is X5 = 71.91%. Find the corresponding value of 25. b. You are given the following: Stock Stock A Stock B R 0.12 ??? 0.20 0.08 It is also given that paB = 0.1. 1. What expected return on stock B would result in an optimal portfolio of A and ?B? Assume short sales are allowed and that R, = 0.04. 2. What expected return on stock B would mean that stock B would not be held? Assume short sales are allowed and that R= 0.04. c. For three stocks you are given the following data based on the single index model: Stock R B 02 A 0.006 0.94 0.0033 B 0.011 0.61 0.0038 0.015 1.12 0.0046 1. Rank the three stocks based on the excess return to beta ratio and complete the table below that will allow you to find the C*. Assume that on = 0.0018. C R-R (R4 - Rp)BI 2-1 Stock RI (R-R) 02 2. Assume short sales are allowed. Find C* and use it to find the composition of the optimal portfolio (point of tangency). 3. Assume short sales are not allowed. Find C* and use it to find the composition of the optimal portfolio. Problem 5 Answer the following questions: a. Consider the classical Markowitz model. Assume Rf = 0.005 and n = 5 stocks. The optimal portfolio (point of tangency) has expected return Rg = 0.01829078 and variance og = 0.01783703. The weight of stock 5 in the composition of the optimal portfolio is X5 = 71.91%. Find the corresponding value of 25. b. You are given the following: Stock Stock A Stock B R 0.12 ??? 0.20 0.08 It is also given that paB = 0.1. 1. What expected return on stock B would result in an optimal portfolio of A and ?B? Assume short sales are allowed and that R, = 0.04. 2. What expected return on stock B would mean that stock B would not be held? Assume short sales are allowed and that R= 0.04. c. For three stocks you are given the following data based on the single index model: Stock R B 02 A 0.006 0.94 0.0033 B 0.011 0.61 0.0038 0.015 1.12 0.0046 1. Rank the three stocks based on the excess return to beta ratio and complete the table below that will allow you to find the C*. Assume that on = 0.0018. C R-R (R4 - Rp)BI 2-1 Stock RI (R-R) 02 2. Assume short sales are allowed. Find C* and use it to find the composition of the optimal portfolio (point of tangency). 3. Assume short sales are not allowed. Find C* and use it to find the composition of the optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts