Question: Problem 5 (arbitrage). Suppose Treasury STRIPS (synthetic zero coupon bonds) are traded for maturities out to 2 years. The yields on these zero coupon bonds

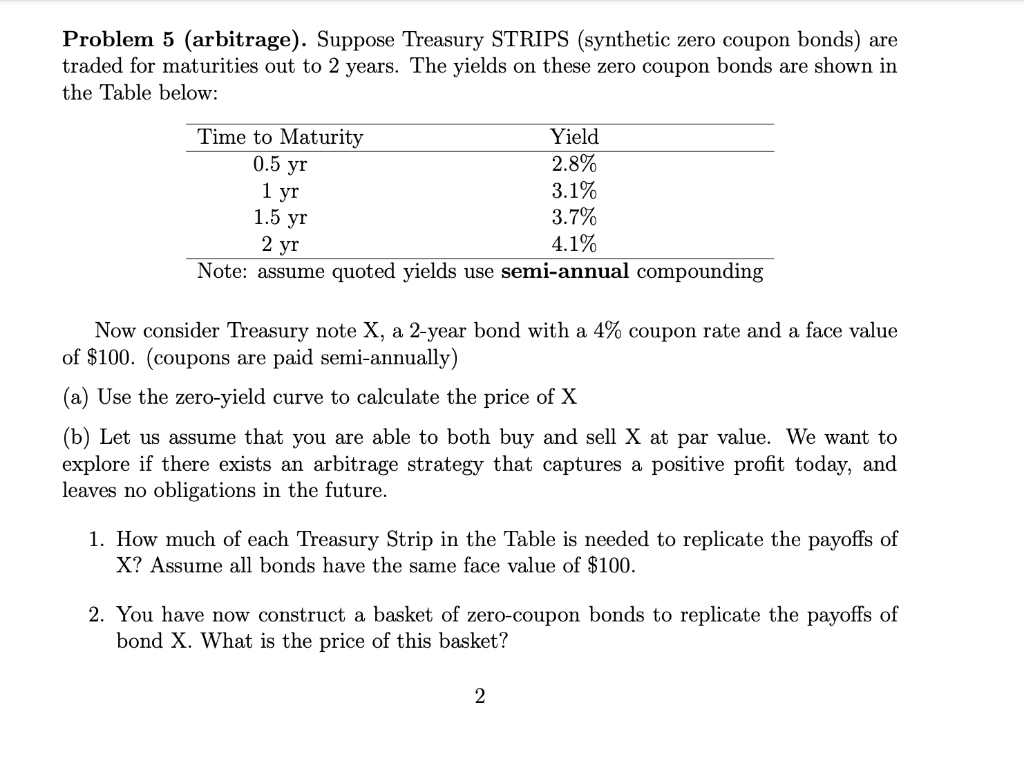

Problem 5 (arbitrage). Suppose Treasury STRIPS (synthetic zero coupon bonds) are traded for maturities out to 2 years. The yields on these zero coupon bonds are shown in the Table below: Time to Maturity Yield 0.5 yr 2.8% 1 yr 3.1% 1.5 yr 3.7% 4.1% Note: assume quoted yields use semi-annual compounding 2 yr Now consider Treasury note X, a 2-year bond with a 4% coupon rate and a face value of $100. (coupons are paid semi-annually) (a) Use the zero-yield curve to calculate the price of X (b) Let us assume that you are able to both buy and sell X at par value. We want to explore if there exists an arbitrage strategy that captures a positive profit today, and leaves no obligations in the future. 1. How much of each Treasury Strip in the Table is needed to replicate the payoffs of X? Assume all bonds have the same face value of $100. 2. You have now construct a basket of zero-coupon bonds to replicate the payoffs of bond X. What is the price of this basket? Problem 5 (arbitrage). Suppose Treasury STRIPS (synthetic zero coupon bonds) are traded for maturities out to 2 years. The yields on these zero coupon bonds are shown in the Table below: Time to Maturity Yield 0.5 yr 2.8% 1 yr 3.1% 1.5 yr 3.7% 4.1% Note: assume quoted yields use semi-annual compounding 2 yr Now consider Treasury note X, a 2-year bond with a 4% coupon rate and a face value of $100. (coupons are paid semi-annually) (a) Use the zero-yield curve to calculate the price of X (b) Let us assume that you are able to both buy and sell X at par value. We want to explore if there exists an arbitrage strategy that captures a positive profit today, and leaves no obligations in the future. 1. How much of each Treasury Strip in the Table is needed to replicate the payoffs of X? Assume all bonds have the same face value of $100. 2. You have now construct a basket of zero-coupon bonds to replicate the payoffs of bond X. What is the price of this basket

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts