Question: Problem 5: Calculating Market Value Ratios Euphonium Corp. had additions to retained earnings for the year just ended of $595,000. The firm paid out $395,000

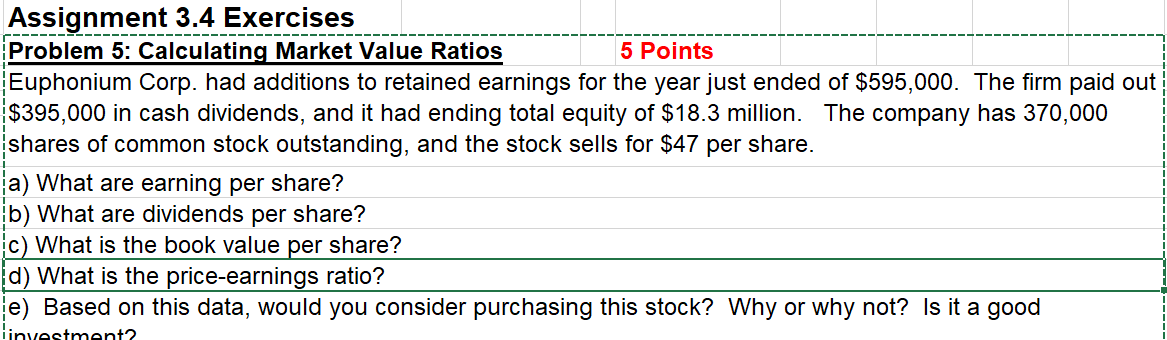

Problem 5: Calculating Market Value Ratios Euphonium Corp. had additions to retained earnings for the year just ended of $595,000. The firm paid out $395,000 in cash dividends, and it had ending total equity of $18.3 million. The company has 370,000 shares of common stock outstanding, and the stock sells for $47 per share. a) What are earning per share?

Assignment 3.4 Exercises Problem 5: Calculating Market Value Ratios 5 Points Euphonium Corp. had additions to retained earnings for the year just ended of \\( \\$ 595,000 \\). The firm paid out \\( \\$ 395,000 \\) in cash dividends, and it had ending total equity of \\( \\$ 18.3 \\) million. The company has 370,000 shares of common stock outstanding, and the stock sells for \\( \\$ 47 \\) per share. a) What are earning per share? b) What are dividends per share? c) What is the book value per share? d) What is the price-earnings ratio? e) Based on this data, would you consider purchasing this stock? Why or why not? Is it a good

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts