Question: Problem 5. Efficient Frontier and the CAPM. Short answer questions. 1. Explain why the efficient frontier must be concave. 2. Suppose that there are

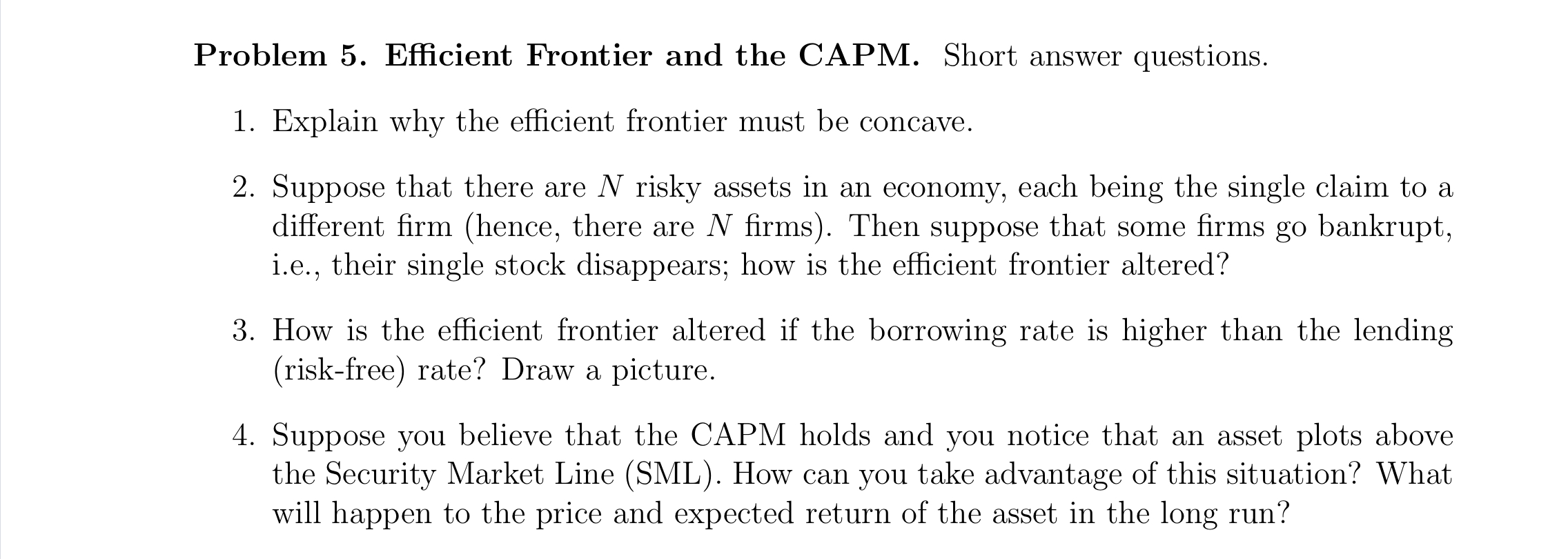

Problem 5. Efficient Frontier and the CAPM. Short answer questions. 1. Explain why the efficient frontier must be concave. 2. Suppose that there are N risky assets in an economy, each being the single claim to a different firm (hence, there are N firms). Then suppose that some firms go bankrupt, i.e., their single stock disappears; how is the efficient frontier altered? 3. How is the efficient frontier altered if the borrowing rate is higher than the lending (risk-free) rate? Draw a picture. 4. Suppose you believe that the CAPM holds and you notice that an asset plots above the Security Market Line (SML). How can you take advantage of this situation? What will happen to the price and expected return of the asset in the long run?

Step by Step Solution

There are 3 Steps involved in it

1 The efficient frontier must be concave because of the principle of diminishing marginal returns As ... View full answer

Get step-by-step solutions from verified subject matter experts