Question: Problem 5: Executing orders (4 points) Say the limit order book for a stock currently looks like this: Offers Bids Price Quantity Price Quantity $5.45

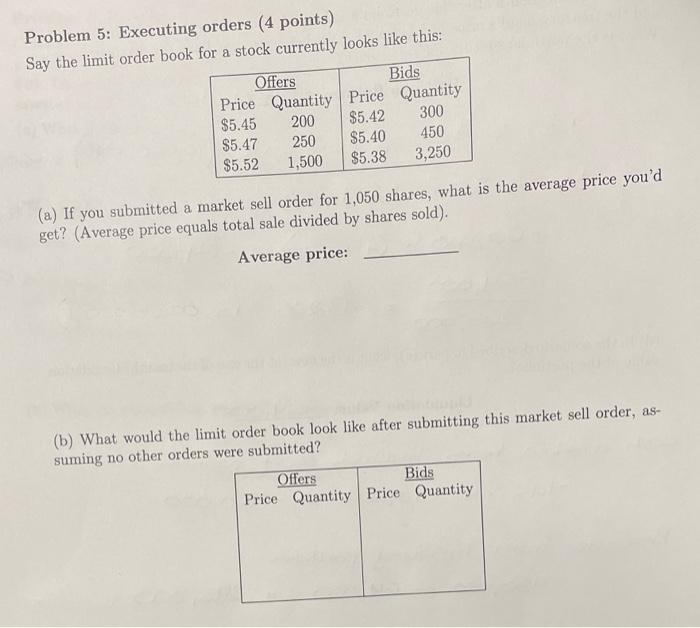

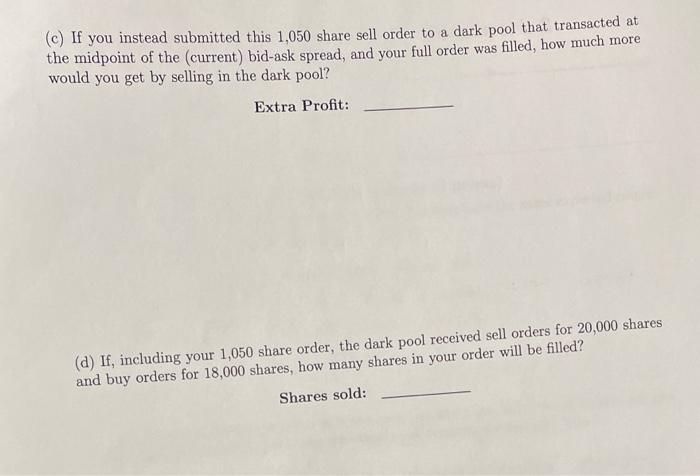

Problem 5: Executing orders (4 points) Say the limit order book for a stock currently looks like this: Offers Bids Price Quantity Price Quantity $5.45 $5.42 300 $5.47 250 $5.40 450 $5.52 1,500 $5.38 3,250 200 (a) If you submitted a market sell order for 1,050 shares, what is the average price you'd get? (Average price equals total sale divided by shares sold). Average price: (b) What would the limit order book look like after submitting this market sell order, as- suming no other orders were submitted? Offers Bids Price Quantity Price Quantity (c) If you instead submitted this 1,050 share sell order to a dark pool that transacted at the midpoint of the (current) bid-ask spread, and your full order was filled, how much more would you get by selling in the dark pool? Extra Profit: (d) If, including your 1,050 share order, the dark pool received sell orders for 20,000 shares and buy orders for 18,000 shares, how many shares in your order will be filled? Shares sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts