Question: Problem #5 is provided. Please answer #6 a/b showing all work (: Problem #5 tity for the 20 rod! No Tell Moodoperates 52 weeks per

Problem #5 is provided. Please answer #6 a/b showing all work (:

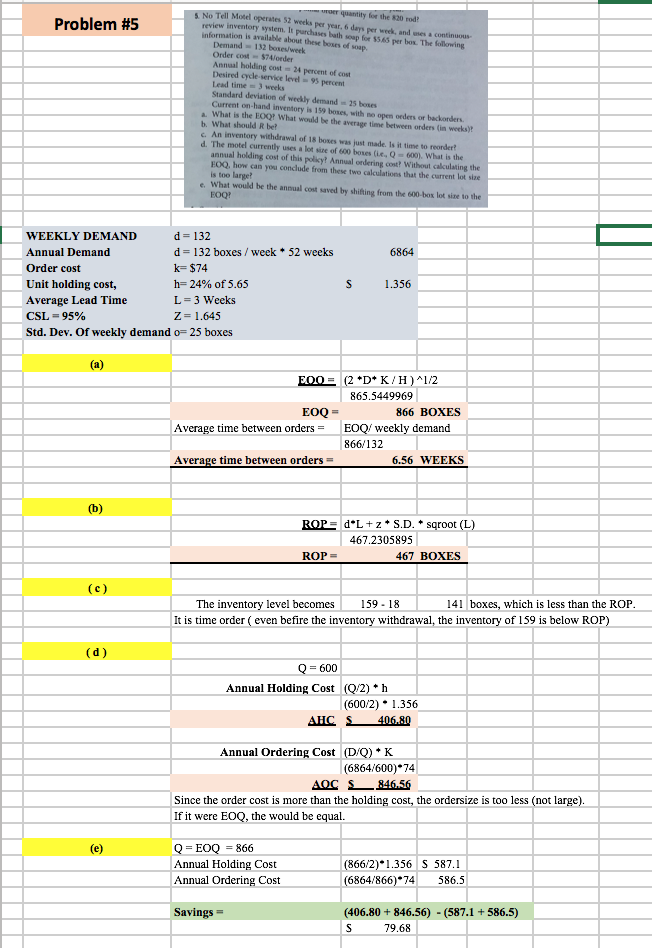

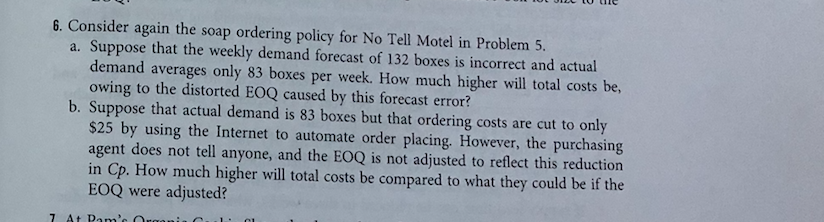

Problem #5 tity for the 20 rod! No Tell Moodoperates 52 weeks per year, 6 days per week and was a co review Inventory system. It purchases bath soap for $5.65 per box. The following information is available about these boxes of soap. Demand 132 boxes Order cost $74/onder Annual holding cost = 24 percent of cost Desired cych service level 95 percem Lead time weeks Standard deviation of wedly demand shoes Current on hand inventory is 159 beses with me open orders or backorders What is the EOQ What would be the average time between orders in werks) b. What should be An inventory withdrawal of 15 boses was just made. Is it time to reorder? d. The motel currently uses a lot of 600 boe 0 60) What is the annual holding cost of this policy? Annual ondering w Wwthout calculating the FOQ, how can you conclude from these two calculations that the current lot size is too large? What would be the annual cost saved by shifting from the 500 bolo sine to the FOO? 52 weeks 6864 WEEKLY DEMAND d=132 Annual Demand d = 132 boxes / week Order cost k-$74 Unit holding cost, h=24% of 5.65 Average Lead Time L= 3 Weeks CSL = 95% Z= 1.645 Std. Dev. Of weekly demand o=25 boxes S 1.356 100 = (2 *D* K/H) 1/2 865.5449969 EOQ = 866 BOXES Average time between orders = EOQ/ weekly demand 866/132 Average time between orders = 6.56 WEEKS ROP = d'L + z. S.D. sgroot (L) 467.2305895 467 BOXES ROP = The inventory level becomes 159-18 141 boxes, which is less than the ROP It is time order ( even befire the inventory withdrawal, the inventory of 159 is below ROP) Q = 600 Annual Holding Cost (0/2)* h (600/2)* 1.356 AHC S 406.80 Annual Ordering Cost (D/Q) * K (6864/600)*74 AOC S 846.56 Since the order cost is more than the holding cost, the ordersize is too less (not large). If it were EOQ, the would be equal. Q = EOQ = 866 Annual Holding Cost Annual Ordering Cost (866/2)*1.356 (6864/866)*74 S 587.1 586.5 Savings = (406.80 + 846.56) - (587.1 + 586.5) S 79.68 6. Consider again the soap ordering policy for No Tell Motel in Problem 5. a. Suppose that the weekly demand forecast of 132 boxes is incorrect and actual demand averages only 83 boxes per week. How much higher will total costs be, owing to the distorted EOQ caused by this forecast error? b. Suppose that actual demand is 83 boxes but that ordering costs are cut to only $25 by using the Internet to automate order placing. However, the purchasing agent does not tell anyone, and the EOQ is not adjusted to reflect this reduction in Cp. How much higher will total costs be compared to what they could be if the EOQ were adjustedStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock