Question: Problem 5 Lily provided the following data to you for taxable year 2023: Net Sales Cost of Goods Sold P19,000,000.00 P4,600,000.00 Other Non-Operating Income

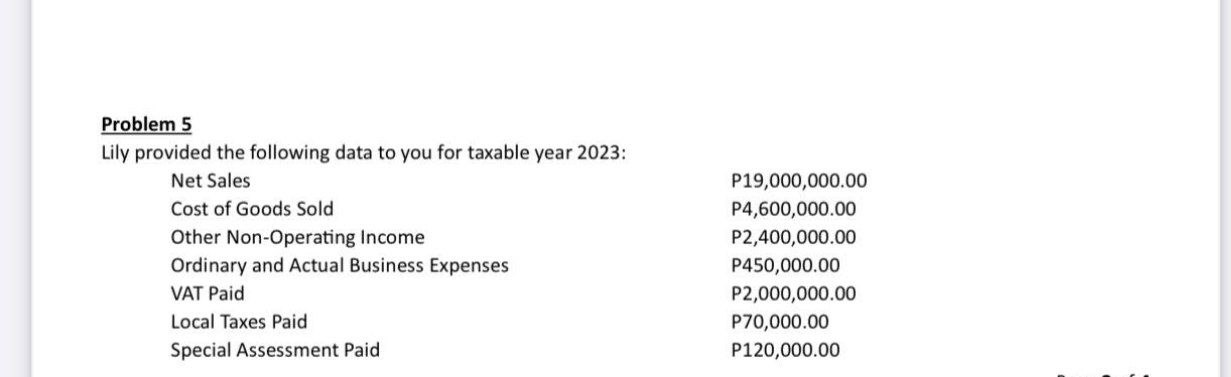

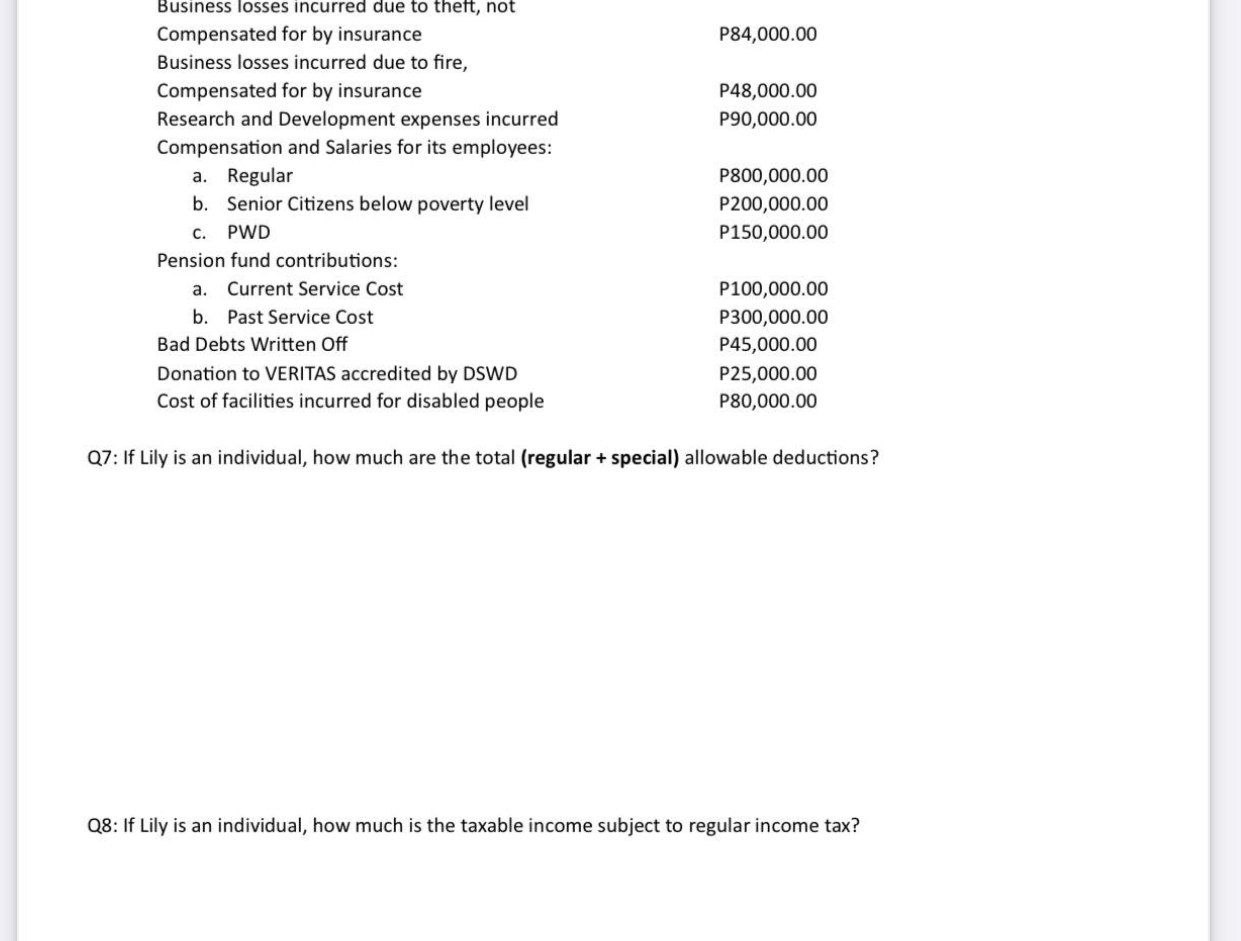

Problem 5 Lily provided the following data to you for taxable year 2023: Net Sales Cost of Goods Sold P19,000,000.00 P4,600,000.00 Other Non-Operating Income Ordinary and Actual Business Expenses VAT Paid Local Taxes Paid Special Assessment Paid P2,400,000.00 P450,000.00 P2,000,000.00 P70,000.00 P120,000.00 Business losses incurred due to theft, not Compensated for by insurance P84,000.00 Business losses incurred due to fire, Compensated for by insurance P48,000.00 Research and Development expenses incurred P90,000.00 Compensation and Salaries for its employees: a. Regular P800,000.00 b. Senior Citizens below poverty level P200,000.00 C. PWD P150,000.00 Pension fund contributions: a. Current Service Cost b. Past Service Cost Bad Debts Written Off Donation to VERITAS accredited by DSWD Cost of facilities incurred for disabled people P100,000.00 P300,000.00 P45,000.00 P25,000.00 P80,000.00 Q7: If Lily is an individual, how much are the total (regular + special) allowable deductions? Q8: If Lily is an individual, how much is the taxable income subject to regular income tax? Q9: If Lily is an individual and opted to use OSD, compute for the taxable income subject to RIT. Q10: If Lily is a domestic corporation and opted to use OSD, compute for the taxable income subject to RIT.

Step by Step Solution

There are 3 Steps involved in it

ANSWER To calculate the total allowable deductions and the taxable income subject to regular income ... View full answer

Get step-by-step solutions from verified subject matter experts