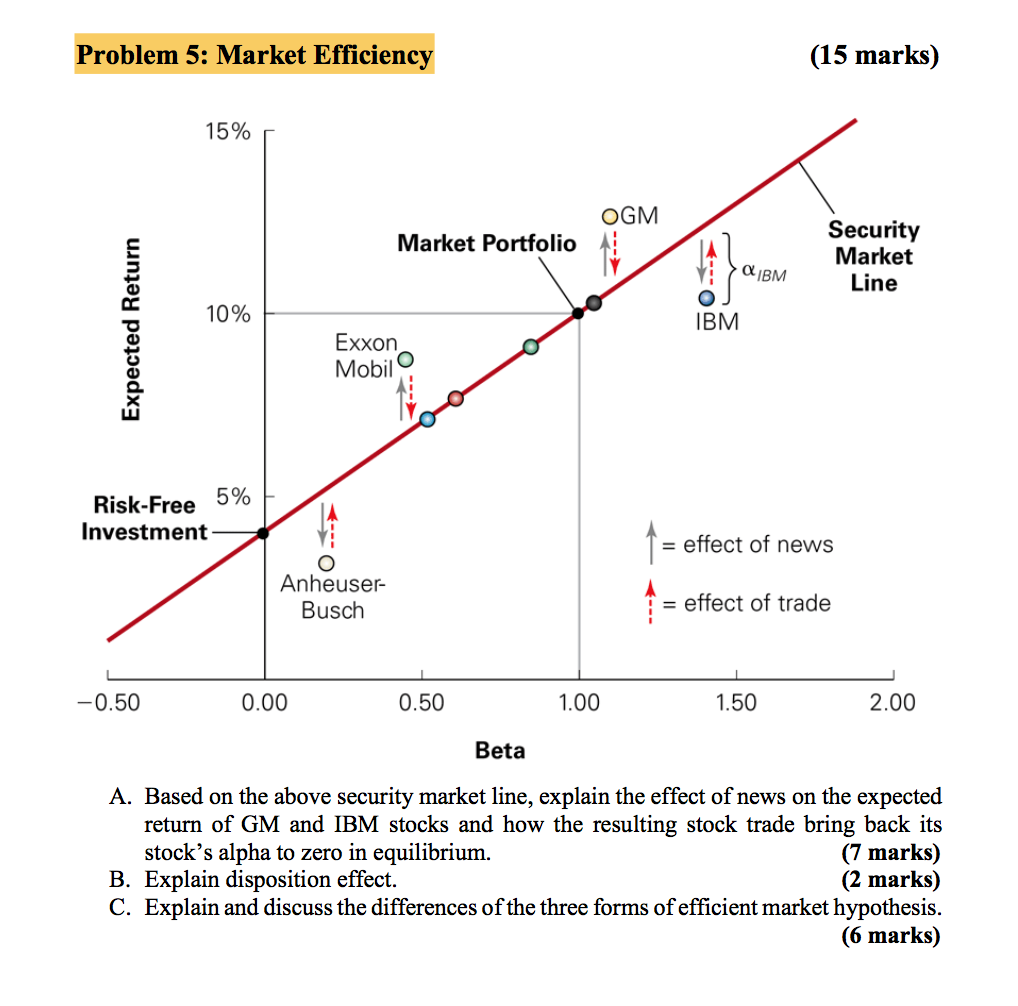

Question: Problem 5: Market Efficiency (15 marks) 15% OGM Security Market Line Market Portfolio 10% IBM Exxon Mobil Risk-Free 5% Investment - effect of news Anheuser-

Problem 5: Market Efficiency (15 marks) 15% OGM Security Market Line Market Portfolio 10% IBM Exxon Mobil Risk-Free 5% Investment - effect of news Anheuser- Busch effect of trade 0.50 0.00 0.50 1.00 1.50 2.00 Beta A. Based on the above security market line, explain the effect of news on the expected return of GM and IBM stocks and how the resulting stock trade bring back its (7 marks) (2 marks) C. Explain and discuss the differences of the three forms of efficient market hypothesis. (6 marks) stock's alpha to zero in equilibrium. B. Explain disposition effect Problem 5: Market Efficiency (15 marks) 15% OGM Security Market Line Market Portfolio 10% IBM Exxon Mobil Risk-Free 5% Investment - effect of news Anheuser- Busch effect of trade 0.50 0.00 0.50 1.00 1.50 2.00 Beta A. Based on the above security market line, explain the effect of news on the expected return of GM and IBM stocks and how the resulting stock trade bring back its (7 marks) (2 marks) C. Explain and discuss the differences of the three forms of efficient market hypothesis. (6 marks) stock's alpha to zero in equilibrium. B. Explain disposition effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts