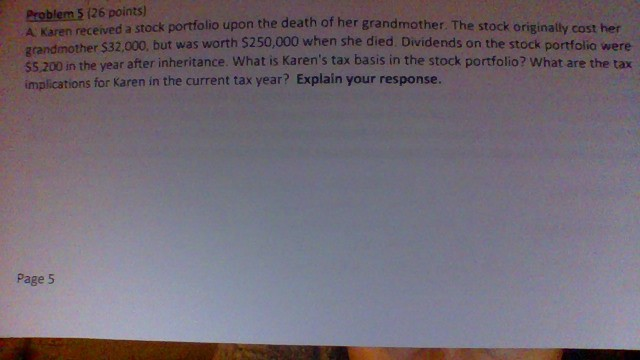

Question: Problem 5. Nee help ASAP Problem 5 126 points) A Karen received a stock portfolio upon the k nortfolio upon the death of her grandmother.

Problem 5. Nee help ASAP

Problem 5 126 points) A Karen received a stock portfolio upon the k nortfolio upon the death of her grandmother. The stock originally cost her other $32.000, but was worth $250,000 when she died Dividends on the stock portfoliore dends on the stock portfolio were 55 200 in the year after inheritance. What is Karen's tax basis in the stock portfolio? What are the tax implications for Karen in the current tax year? Explain your response. Page 5 Problem 5 126 points) A Karen received a stock portfolio upon the k nortfolio upon the death of her grandmother. The stock originally cost her other $32.000, but was worth $250,000 when she died Dividends on the stock portfoliore dends on the stock portfolio were 55 200 in the year after inheritance. What is Karen's tax basis in the stock portfolio? What are the tax implications for Karen in the current tax year? Explain your response. Page 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts