Question: Problem 5: No Arbitrage among two Zero Coupon bonds Suppose the market price of a zero coupon bond with face value of $100 and maturity

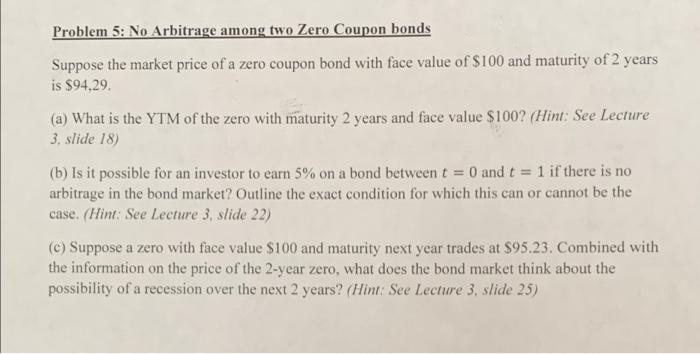

Problem 5: No Arbitrage among two Zero Coupon bonds Suppose the market price of a zero coupon bond with face value of $100 and maturity of 2 years is $94,29. (a) What is the YTM of the zero with maturity 2 years and face value $1002 (Hint: See Lecture 3. slide 18) (b) Is it possible for an investor to earn 5% on a bond between t = 0 and t = 1 if there is no arbitrage in the bond market? Outline the exact condition for which this can or cannot be the case. (Hint: See Lecture 3. slide 22) (C) Suppose a zero with face value $100 and maturity next year trades at $95.23. Combined with the information on the price of the 2-year zero, what does the bond market think about the possibility of a recession over the next 2 years? (Hint: See Lecture 3, slide 25)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts