Question: Problem 5 : Option Strategy: Bear Spread Suppose you buy one Texas Instruments August 8 5 ( strike price ) put contract quoted at $

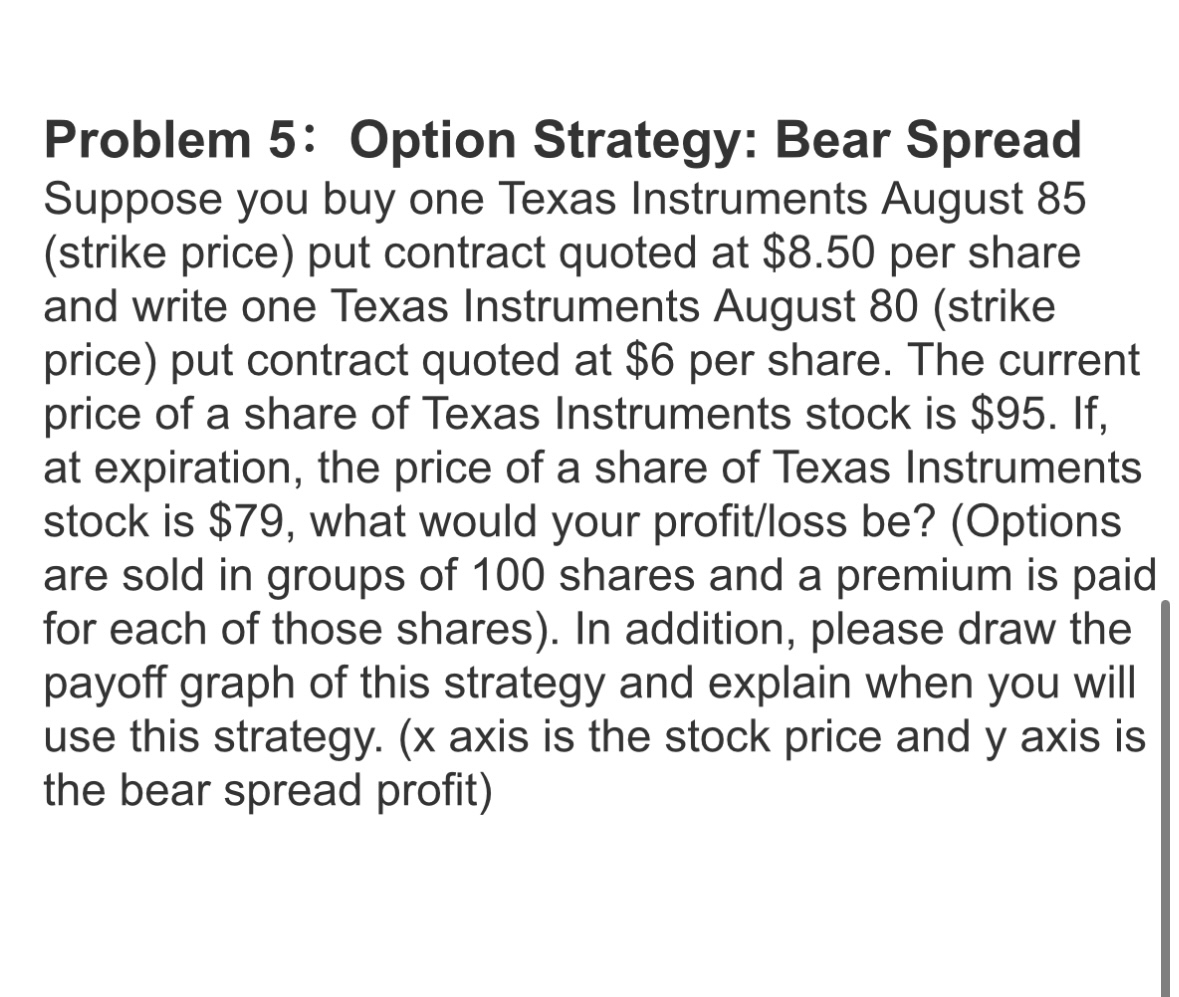

Problem : Option Strategy: Bear Spread

Suppose you buy one Texas Instruments August strike price put contract quoted at $ per share and write one Texas Instruments August strike price put contract quoted at $ per share. The current price of a share of Texas Instruments stock is $ If at expiration, the price of a share of Texas Instruments stock is $ what would your profitloss beOptions are sold in groups of shares and a premium is paid for each of those shares In addition, please draw the payoff graph of this strategy and explain when you will use this strategy. axis is the stock price and axis is the bear spread profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock