Question: Problem 5: Portfolio Return Properties (3 points) You are a US-based investor who likes expected return and dislikes variance. There are 2 stocks available to

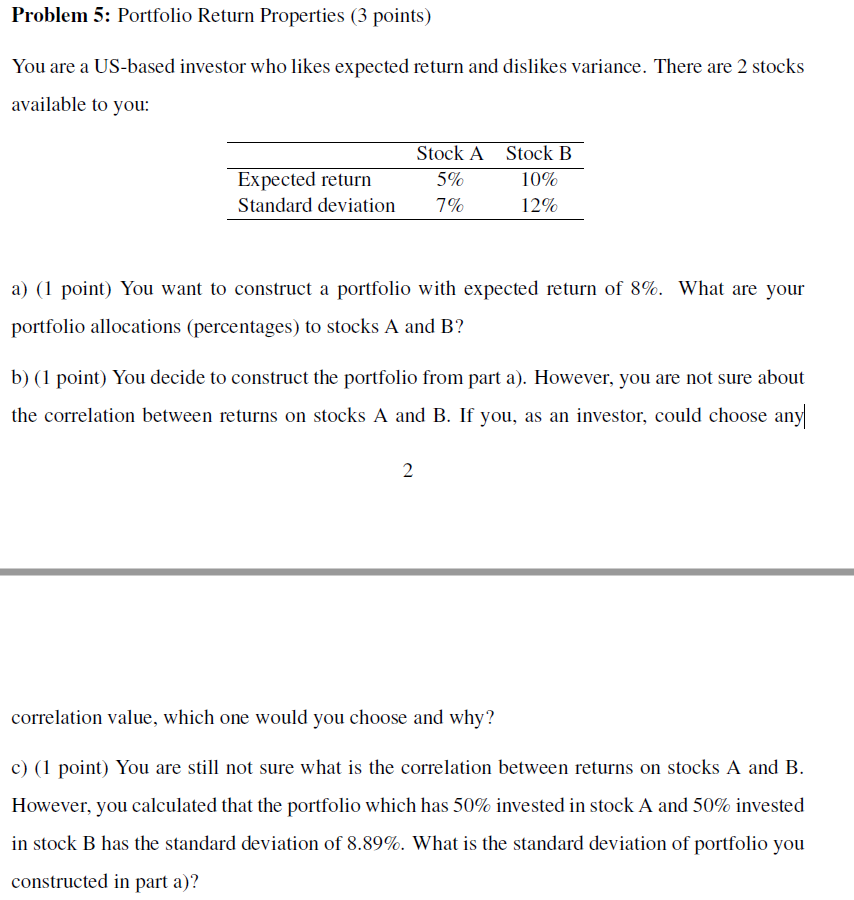

Problem 5: Portfolio Return Properties (3 points) You are a US-based investor who likes expected return and dislikes variance. There are 2 stocks available to you: Expected return Standard deviation Stock A Stock B 5% 10% 7% 12% a) (1 point) You want to construct a portfolio with expected return of 8%. What are your portfolio allocations (percentages) to stocks A and B? b) (1 point) You decide to construct the portfolio from part a). However, you are not sure about the correlation between returns on stocks A and B. If you, as an investor, could choose any 2. correlation value, which one would you choose and why? c) (1 point) You are still not sure what is the correlation between returns on stocks A and B. However, you calculated that the portfolio which has 50% invested in stock A and 50% invested in stock B has the standard deviation of 8.89%. What is the standard deviation of portfolio you constructed in part a)? Problem 5: Portfolio Return Properties (3 points) You are a US-based investor who likes expected return and dislikes variance. There are 2 stocks available to you: Expected return Standard deviation Stock A Stock B 5% 10% 7% 12% a) (1 point) You want to construct a portfolio with expected return of 8%. What are your portfolio allocations (percentages) to stocks A and B? b) (1 point) You decide to construct the portfolio from part a). However, you are not sure about the correlation between returns on stocks A and B. If you, as an investor, could choose any 2. correlation value, which one would you choose and why? c) (1 point) You are still not sure what is the correlation between returns on stocks A and B. However, you calculated that the portfolio which has 50% invested in stock A and 50% invested in stock B has the standard deviation of 8.89%. What is the standard deviation of portfolio you constructed in part a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts