Question: PROBLEM 5 - provide interest rates with no decimal points. United Housing is considering investing in two projects: One project is the construction of an

PROBLEM provide interest rates with no decimal points.

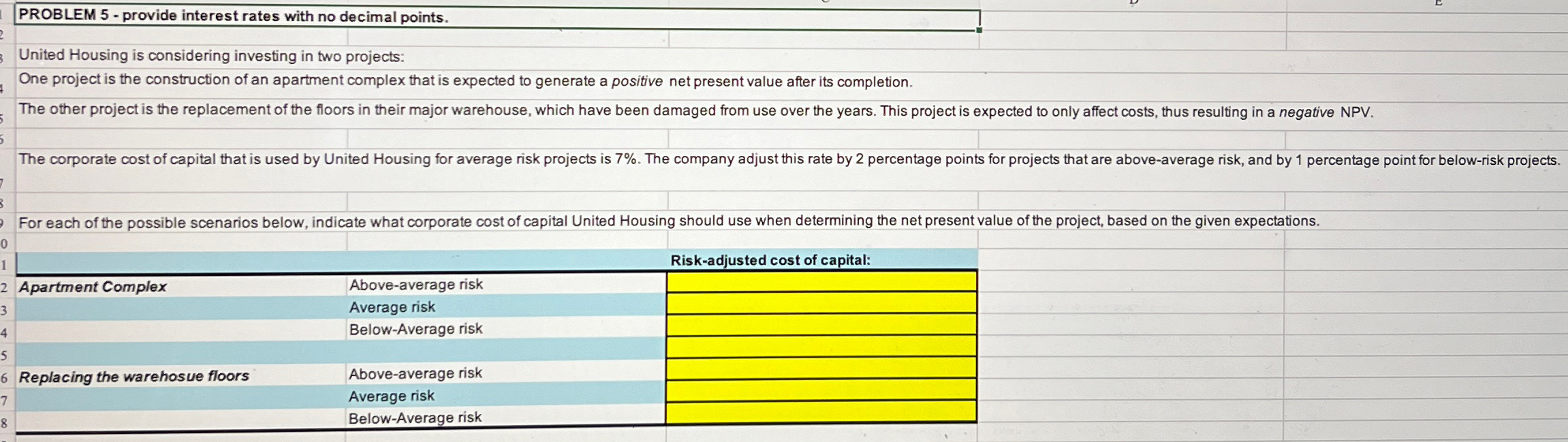

United Housing is considering investing in two projects:

One project is the construction of an apartment complex that is expected to generate a positive net present value after its completion.

The other project is the replacement of the floors in their major warehouse, which have been damaged from use over the years. This project is expected to only affect costs, thus resulting in a negative NPV

The corporate cost of capital that is used by United Housing for average risk projects is The company adjust this rate by percentage points for projects that are aboveaverage risk, and by percentage point for belowrisk projects.

For each of the possible scenarios below, indicate what corporate cost of capital United Housing should use when determining the net present value of the project, based on the given expectations.

tableRiskadjusted cost of capital:Apartment Complex,Aboveaverage risk,,Average risk,,BelowAverage risk,,Replacing the warehosue floors,Aboveaverage risk,,Average risk,,BelowAverage risk,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock