Question: Problem 5: Saving for Future. Please fill in the cells highlighted in GREEN. Your uncle is 55 years old today, and he wishes to start

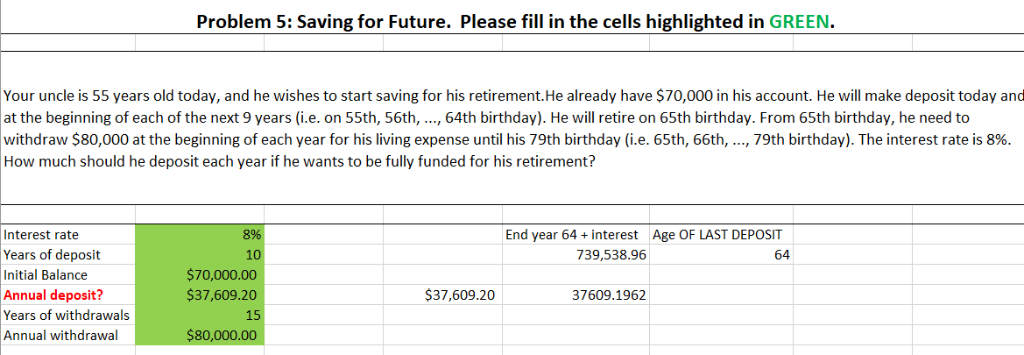

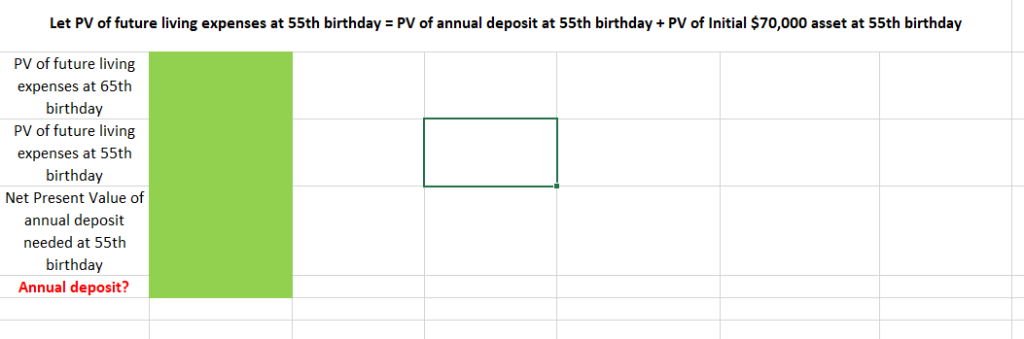

Problem 5: Saving for Future. Please fill in the cells highlighted in GREEN. Your uncle is 55 years old today, and he wishes to start saving for his retirement.He already have $70,000 in his account. He will make deposit today and at the beginning of each of the next 9 years (i.e. on 55th, 56th, ., 64th birthday). He will retire on 65th birthday. From 65th birthday, he need to withdraw $80,000 at the beginning of each year for his living expense until his 79th birthday (ie, 65th, 66th, , 79th birthday). The interest rate is 8%. How much should he deposit each year if he wants to be fully funded for his retirement? 8% 10 $70,000.00 $37,609.20 15 $80,000.00 End year 64+interest Age OF LAST DEPOSIT Interest rate Years of deposit Initial Balance Annual deposit? Years of withdrawals Annual withdrawal 739,538.96 64 37,609.20 37609.1962 Let PV of future living expenses at 55th birthday PV of annual deposit at 55th birthday+ PV of Initial $70,000 asset at 55th birthday PV of future living expenses at 65th birthday PV of future living expenses at 55th birthday Net Present Value of annual deposit needed at 55th birthday Annual deposit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts