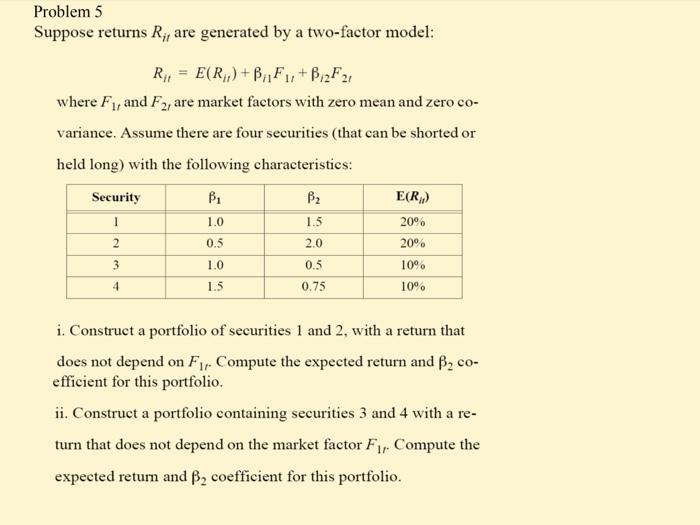

Question: Problem 5 Suppose returns R;, are generated by a two-factor model: R;, = E(R) + BF1,+B2F21 where F1, and F2, are market factors with zero

Problem 5 Suppose returns R;, are generated by a two-factor model: R;, = E(R) + BF1,+B2F21 where F1, and F2, are market factors with zero mean and zero co- variance. Assume there are four securities that can be shorted or held long) with the following characteristics: Security B2 E(R) 1 1.0 1.5 2 2.0 20% 1.0 1.5 0.75 10% 20 0.5 3 0.5 10% 4 i. Construct a portfolio of securities 1 and 2, with a return that does not depend on Fir Compute the expected return and B2 co- efficient for this portfolio. ii. Construct a portfolio containing securities 3 and 4 with a re- turn that does not depend on the market factor Fr. Compute the expected return and B2 coefficient for this portfolio. Problem 5 Suppose returns R;, are generated by a two-factor model: R;, = E(R) + BF1,+B2F21 where F1, and F2, are market factors with zero mean and zero co- variance. Assume there are four securities that can be shorted or held long) with the following characteristics: Security B2 E(R) 1 1.0 1.5 2 2.0 20% 1.0 1.5 0.75 10% 20 0.5 3 0.5 10% 4 i. Construct a portfolio of securities 1 and 2, with a return that does not depend on Fir Compute the expected return and B2 co- efficient for this portfolio. ii. Construct a portfolio containing securities 3 and 4 with a re- turn that does not depend on the market factor Fr. Compute the expected return and B2 coefficient for this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts