Question: PROBLEM 5. Suppose today is Oct 13, 2016 and consider a corporate bond maturing Dec 18, 2020 that pays semiannual coupons at an annual rate

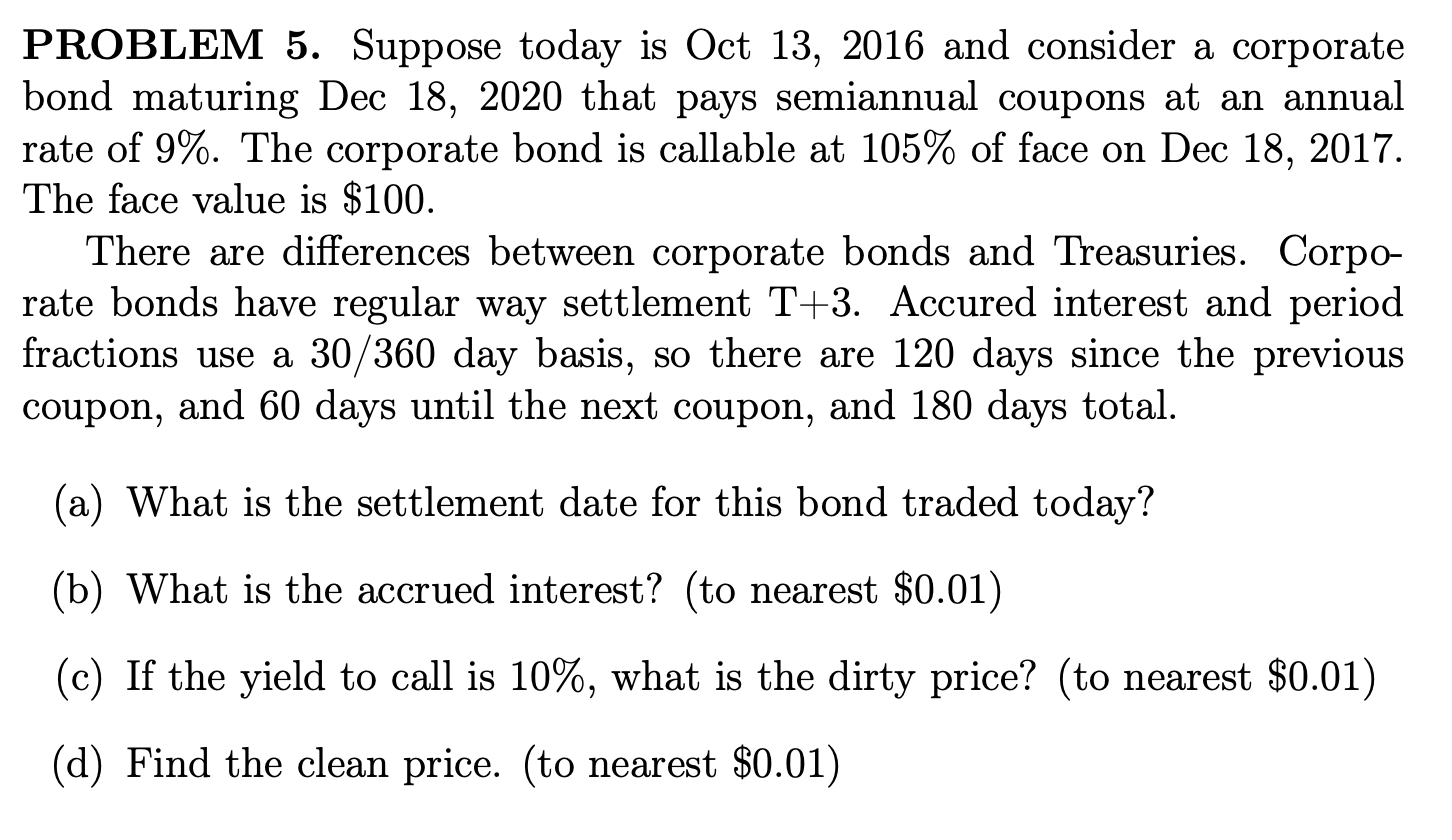

PROBLEM 5. Suppose today is Oct 13, 2016 and consider a corporate bond maturing Dec 18, 2020 that pays semiannual coupons at an annual rate of 9%. The corporate bond is callable at 105% of face on Dec 18, 2017. The face value is $100. There are differences between corporate bonds and Treasuries. Corpo- rate bonds have regular way settlement T+3. Accured interest and period fractions use a 30/360 day basis, so there are 120 days since the previous coupon, and 60 days until the next coupon, and 180 days total. (a) What is the settlement date for this bond traded today? (b) What is the accrued interest? (to nearest $0.01) (c) If the yield to call is 10%, what is the dirty price? (to nearest $0.01) (d) Find the clean price. (to nearest $0.01) PROBLEM 5. Suppose today is Oct 13, 2016 and consider a corporate bond maturing Dec 18, 2020 that pays semiannual coupons at an annual rate of 9%. The corporate bond is callable at 105% of face on Dec 18, 2017. The face value is $100. There are differences between corporate bonds and Treasuries. Corpo- rate bonds have regular way settlement T+3. Accured interest and period fractions use a 30/360 day basis, so there are 120 days since the previous coupon, and 60 days until the next coupon, and 180 days total. (a) What is the settlement date for this bond traded today? (b) What is the accrued interest? (to nearest $0.01) (c) If the yield to call is 10%, what is the dirty price? (to nearest $0.01) (d) Find the clean price. (to nearest $0.01)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts