Question: Problem 5: This problem asks you to build a multi-period binomial model pricer for European derivatives with pay-offs of the form f(SN ) for some

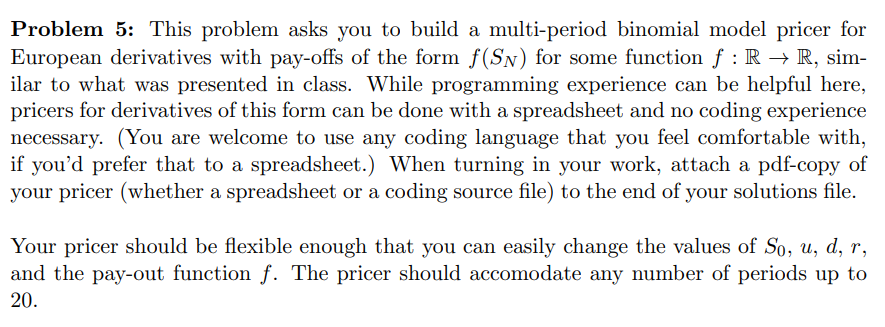

Problem 5: This problem asks you to build a multi-period binomial model pricer for European derivatives with pay-offs of the form f(SN ) for some function f : R R, similar to what was presented in class. While programming experience can be helpful here, pricers for derivatives of this form can be done with a spreadsheet and no coding experience necessary. (You are welcome to use any coding language that you feel comfortable with, if youd prefer that to a spreadsheet.) When turning in your work, attach a pdf-copy of your pricer (whether a spreadsheet or a coding source file) to the end of your solutions file.

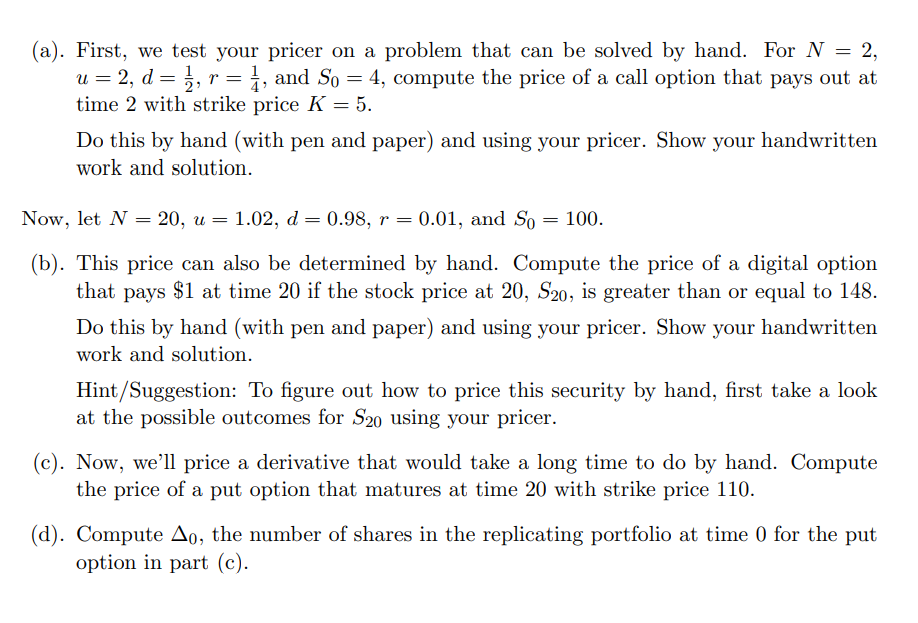

Problem 5: This problem asks you to build a multi-period binomial model pricer for European derivatives with pay-offs of the form f(SN) for some function f: R + R, sim- ilar to what was presented in class. While programming experience can be helpful here, pricers for derivatives of this form can be done with a spreadsheet and no coding experience necessary. (You are welcome to use any coding language that you feel comfortable with, if you'd prefer that to a spreadsheet.) When turning in your work, attach a pdf-copy of your pricer (whether a spreadsheet or a coding source file) to the end of your solutions file. Your pricer should be flexible enough that you can easily change the values of So, u, d, r, and the pay-out function f. The pricer should accomodate any number of periods up to 20. (a). First, we test your pricer on a problem that can be solved by hand. For N = 2, u = 2, d = 1, r = 1, and So = 4, compute the price of a call option that pays out at time 2 with strike price K = 5. Do this by hand (with pen and paper) and using your pricer. Show your handwritten work and solution. Now, let N = 20, u = 1.02, d= 0.98, r = 0.01, and So 100. (b). This price can also be determined by hand. Compute the price of a digital option that pays $1 at time 20 if the stock price at 20, S20, is greater than or equal to 148. Do this by hand (with pen and paper) and using your pricer. Show your handwritten work and solution. Hint/Suggestion: To figure out how to price this security by hand, first take a look at the possible outcomes for S20 using your pricer. (c). Now, we'll price a derivative that would take a long time to do by hand. Compute the price of a put option that matures at time 20 with strike price 110. (d). Compute Ao, the number of shares in the replicating portfolio at time 0 for the put option in part (c). Problem 5: This problem asks you to build a multi-period binomial model pricer for European derivatives with pay-offs of the form f(SN) for some function f: R + R, sim- ilar to what was presented in class. While programming experience can be helpful here, pricers for derivatives of this form can be done with a spreadsheet and no coding experience necessary. (You are welcome to use any coding language that you feel comfortable with, if you'd prefer that to a spreadsheet.) When turning in your work, attach a pdf-copy of your pricer (whether a spreadsheet or a coding source file) to the end of your solutions file. Your pricer should be flexible enough that you can easily change the values of So, u, d, r, and the pay-out function f. The pricer should accomodate any number of periods up to 20. (a). First, we test your pricer on a problem that can be solved by hand. For N = 2, u = 2, d = 1, r = 1, and So = 4, compute the price of a call option that pays out at time 2 with strike price K = 5. Do this by hand (with pen and paper) and using your pricer. Show your handwritten work and solution. Now, let N = 20, u = 1.02, d= 0.98, r = 0.01, and So 100. (b). This price can also be determined by hand. Compute the price of a digital option that pays $1 at time 20 if the stock price at 20, S20, is greater than or equal to 148. Do this by hand (with pen and paper) and using your pricer. Show your handwritten work and solution. Hint/Suggestion: To figure out how to price this security by hand, first take a look at the possible outcomes for S20 using your pricer. (c). Now, we'll price a derivative that would take a long time to do by hand. Compute the price of a put option that matures at time 20 with strike price 110. (d). Compute Ao, the number of shares in the replicating portfolio at time 0 for the put option in part (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts