Question: Problem 5: Thuy has option contracts that give her the right to sell GE stock at $40 per share. In exchange, she pays a total

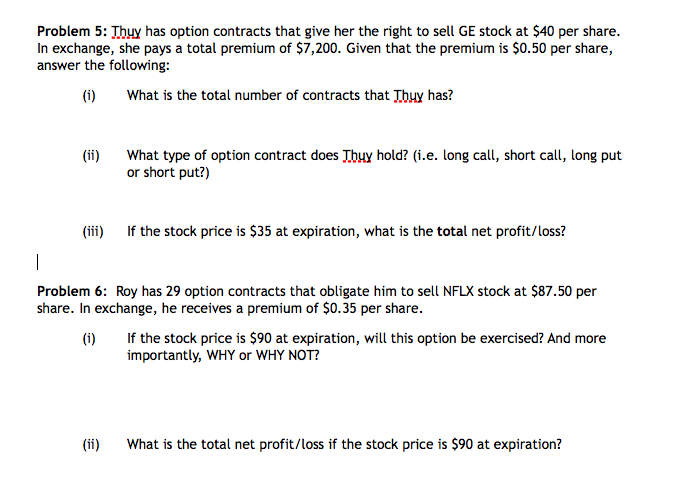

Problem 5: Thuy has option contracts that give her the right to sell GE stock at $40 per share. In exchange, she pays a total premium of $7,200. Given that the premium is $0.50 per share, answer the following: (1) What is the total number of contracts that Thuy has? (ii) What type of option contract does Thuy hold? (i.e. long call, short call, long put or short put?) (iii) If the stock price is $35 at expiration, what is the total net profit/Loss? | Problem 6: Roy has 29 option contracts that obligate him to sell NFLX stock at $87.50 per share. In exchange, he receives a premium of $0.35 per share. (i) If the stock price is $90 at expiration, will this option be exercised? And more importantly, WHY or WHY NOT? (ii) What is the total net profit/loss if the stock price is $90 at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts