Question: Problem 5 Time Value Analysis Solving for Deferred Annuity You are considering making an investment at a rate of 10% that will provide three equal

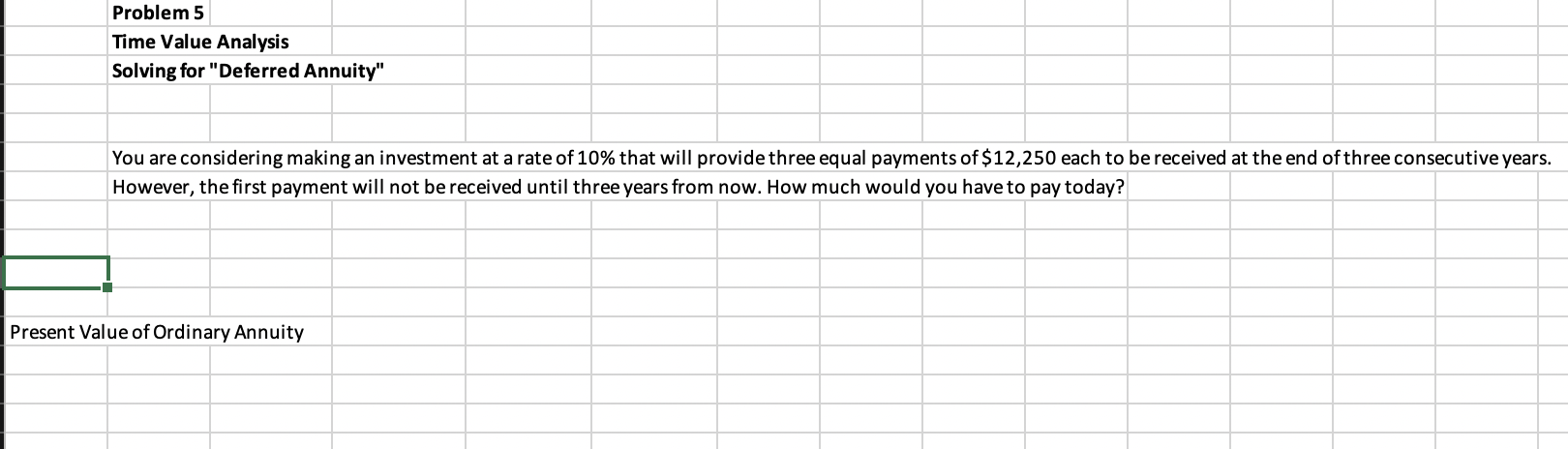

Problem 5 Time Value Analysis Solving for "Deferred Annuity" You are considering making an investment at a rate of 10% that will provide three equal payments of $12,250 each to be received at the end of three consecutive years. However, the first payment will not be received until three years from now. How much would you have to pay today? Present Value of Ordinary Annuity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock