Question: problem 50 20 years Trom the date they were issued and the interest rate in the marketplace is now 12% per year, compounded semiannually, SO

problem 50

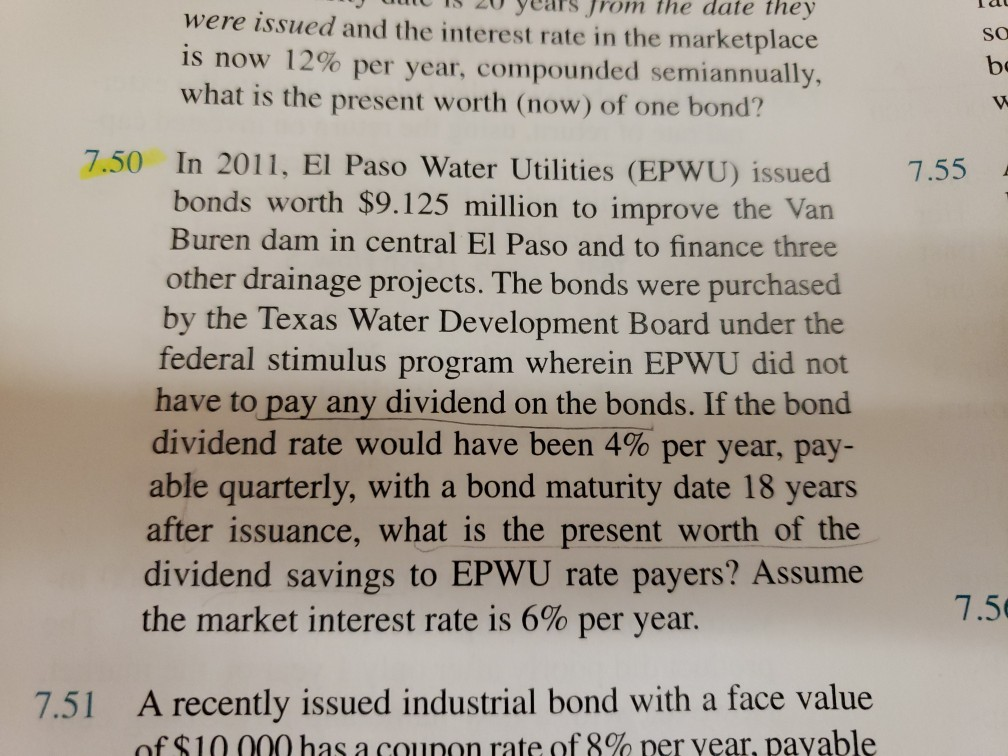

20 years Trom the date they were issued and the interest rate in the marketplace is now 12% per year, compounded semiannually, SO be what is the present worth (now) of one bond? 7.50 In 2011, El Paso Water Utilities (EPWU) issued 7.55 bonds worth $9.125 million to improve the Van Buren dam in central El Paso and to finance three other drainage projects. The bonds were purchased by the Texas Water Development Board under the federal stimulus program wherein EPWU did not have to pay any dividend on the bonds. If the bond dividend rate would have been 4% per year, pay- able quarterly, with a bond maturity date 18 years after issuance, what is the present worth of the dividend savings to EPWU rate payers? Assume 7.5 the market interest rate is 6% per year. A recently issued industrial bond with a face value of $ 1 0 000 has a coupon rate of 8% per year, payable 7.51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts