Question: Problem 5.1. A stock that not pay any dividend is currently trading at $60. After one period, the price will either increase by 20% or

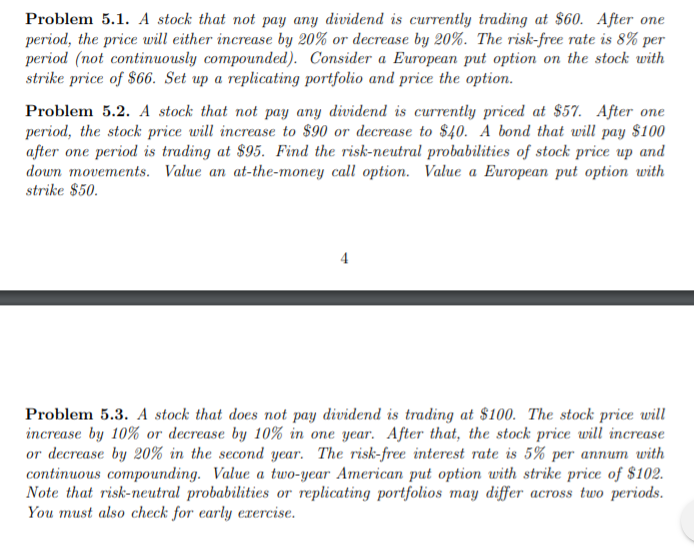

Problem 5.1. A stock that not pay any dividend is currently trading at $60. After one period, the price will either increase by 20% or decrease by 20%. The risk-free rate is 8% per period (not continuously compounded). Consider a European put option on the stock with strike price of $66. Set up a replicating portfolio and price the option. Problem 5.2. A stock that not pay any dividend is currently priced at $57. After one period, the stock price will increase to $90 or decrease to $40. A bond that will pay $100 after one period is trading at $95. Find the risk-neutral probabilities of stock price up and down movements. Value an at-the-money call option. Value a European put option with strike $50. Problem 5.3. A stock that does not pay dividend is trading at $100. The stock price will increase by 10% or decrease by 10% in one year. After that, the stock price will increase or decrease by 20% in the second year. The risk-free interest rate is 5% per annum with continuous compounding. Value a two-year American put option with strike price of $102. Note that risk-neutral probabilities or replicating portfolios may differ across two periods. You must also check for early exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts