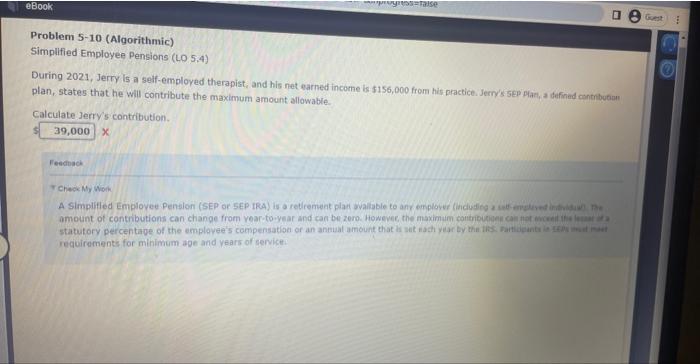

Question: Problem 5-10 (Algorithmic) Simplified Employee Pensions (L.0 5.4) During 2021, Jerry Is a self-emploved therapist, and his net earned income is $156,000 from his practice.

Problem 5-10 (Algorithmic) Simplified Employee Pensions (L.0 5.4) During 2021, Jerry Is a self-emploved therapist, and his net earned income is $156,000 from his practice. Jerry's 5 Sip Plath 2 a defined cantrbutan plan, states that he will contribute the maximum amount allowable. Calculate Jerry's contribution. x Fendiback T check My wioth. amount of contributions can change from year-foryear and can be zero. howevee, the maximaim contripusiges can fiat ficenif if le af if requirements for minimum age and years of servicet. Problem 5-10 (Algorithmic) Simplified Employee Pensions (205.4) During 2021, Jerry is a self-employed therapist, and his net earned income is $156,000 from his practice. Jerry's SEP. Plan, a defined plan, states that he will contribute the maximum amount allowable. Calculate Jerry's contribution. x

Step by Step Solution

There are 3 Steps involved in it

Problem Given Jerrys net earned income selfemployed for 2021 156000 Jerry wants to contribute the ma... View full answer

Get step-by-step solutions from verified subject matter experts