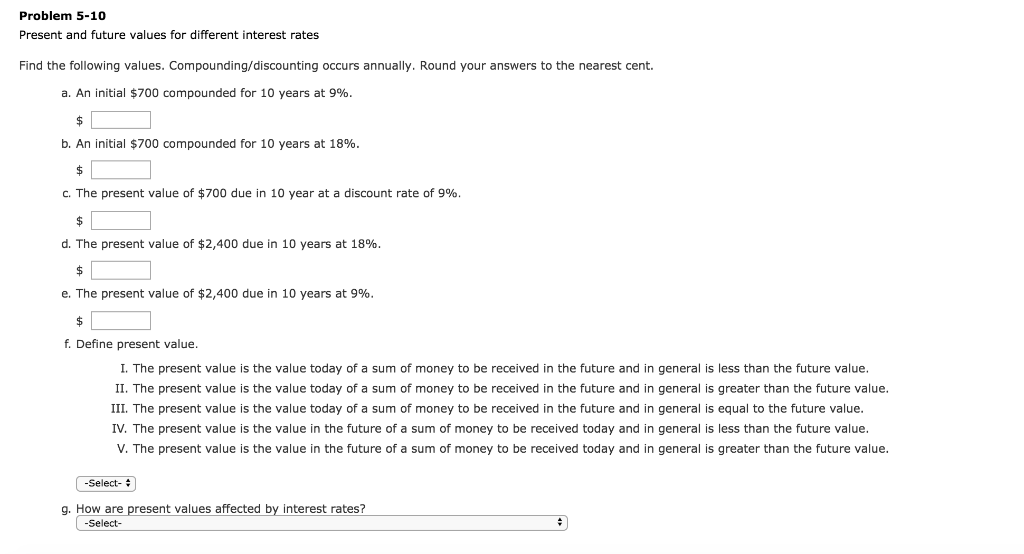

Question: Problem 5-10 Present and future values for different interest rates Find the following values. Compounding/discounting occurs annually. Round your answers to the nearest cent. a.

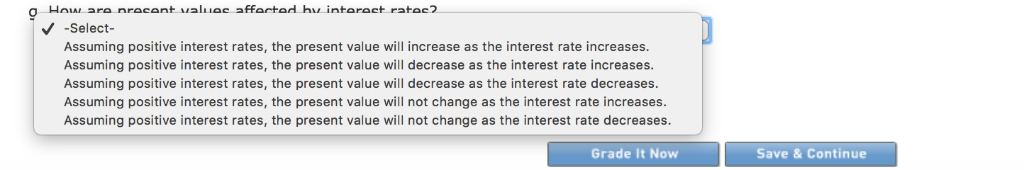

Problem 5-10 Present and future values for different interest rates Find the following values. Compounding/discounting occurs annually. Round your answers to the nearest cent. a. An initial $700 compounded for 10 years at 9%. $ b. An initial $700 compounded for 10 years at 18%. The present value of $700 due in 10 year at a discount rate of 9% $ The present value of $2,400 due in 10 years at 18% $ The present value of $2,400 due in 10 years at 9% Define present value. I. The present value is the value today of a sum of money to be received in the future and in general is less than the future value. II. The present value s the value today of a sum of money to be received in the future and in general is greater than the future value. III. The present value s the value today of a sum of money to be received in the future and in general is equal to the future value. IV. The present value is the value in the future of a sum of money to be received today and in general is less than the future value. V. The present value is the value in e future of a sum of money to be received today and in general is greater than the future value. -Select-5 g.How are present values affected by interest rates? -Select- How are present values affected bv interact ratec2 -Select- Assuming positive interest rates, the present value will increase as the interest rate increases. Assuming positive interest rates, the present value will decrease as the interest rate increases. Assuming positive interest rates, the present value will decrease as the interest rate decreases. Assuming positive interest rates, the present value will not change as the interest rate increases. Assuming positive interest rates, the present value will not change as the interest rate decreases. Save & Continue Grade It Now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts