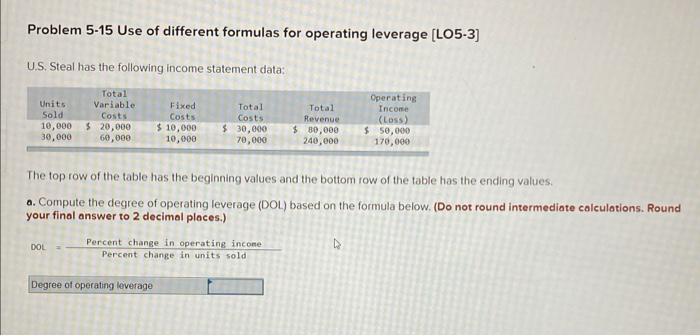

Question: Problem 5-15 Use of different formulas for operating leverage (LO5-3) U.S. Steal has the following income statement data: Total Units Variable Sold Costs 10,000 $20,000

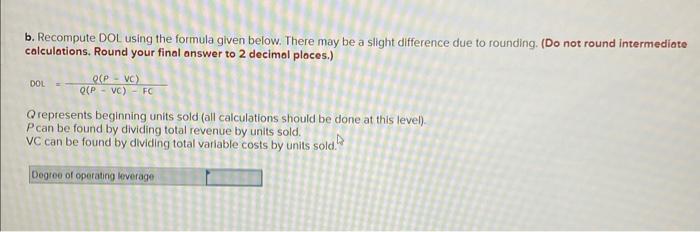

Problem 5-15 Use of different formulas for operating leverage (LO5-3) U.S. Steal has the following income statement data: Total Units Variable Sold Costs 10,000 $20,000 30,000 60,000 Fixed Costs $ 10,000 10,000 Total Costs $ 30,000 70,000 Total Revenue $ 30,000 240.000 Operating Income (Loss) $50,000 170,000 The top row of the table has the beginning values and the bottom row of the table has the ending values a. Compute the degree of operating leverage (DOL) based on the formula below. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Percent change in operating income DOL Percent change in units sold Degree of operating leverage DOL b. Recompute DOL using the formula given below. There may be a slight difference due to rounding. (Do not round intermediate calculations, Round your final answer to 2 decimal places.) OCP - VC) Q( PVC) - FC Qrepresents beginning units sold (all calculations should be done at this level) P can be found by dividing total revenue by units sold. VC can be found by dividing total variable costs by units sold. Degree of operating leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts