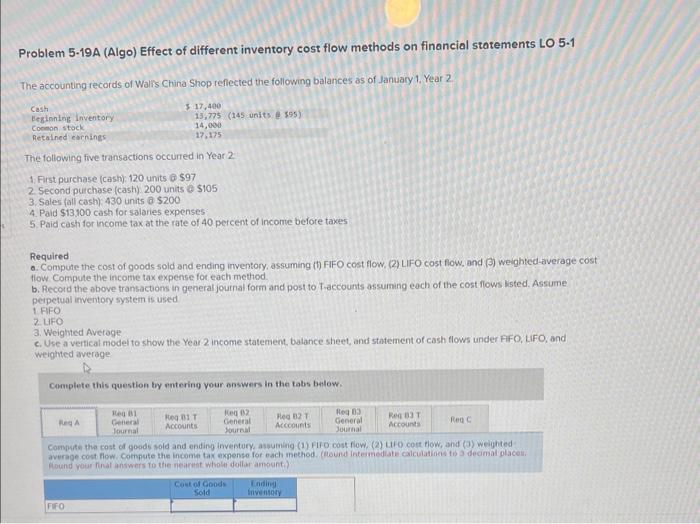

Question: Problem 5-19A (Algo) Effect of different inventory cost flow methods on financial statements LO 5-1 The accounting records of Walrs China Shop refiected the following

Problem 5-19A (Algo) Effect of different inventory cost flow methods on financial statements LO 5-1 The accounting records of Walrs China Shop refiected the following balances as of January 1. Year 2 The following five transactions occurred in Year 2 1. First purchase (cash): 120 units $97 2. Second purchase (cast) 200 units 6 \$105 3. Sales (all cash) 430 units a $200 4. Pand $13,100 cash for salaries expenses 5. Paid castifor income tax at the rate of 40 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow Compute the income tax expense for each method b. Record the obove transactions in general journal form and post to Traccounts assuming each of the cost flows ksted. Assume peipetual inventory system is used 1. FIFO 7. HFO 3. Weighted Averoge c. Use a vertical model to show the Year 2 income statement, batance sheet, and statement of cash flows under FFFO, LFF, and weighted average Complete this question ty entering your onswers in the tabs bitow. Compren the cost of goods sold and ending inventery, asquming (1) FiFo cost fiow, (2) Lto cort fow, and (a) weighted average cont flow. Compute the income tax expense for each method. (hound intemediate calcuiations to 3 dedmal olacei. Gound your final answers to the reearent whole dellar ampont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts