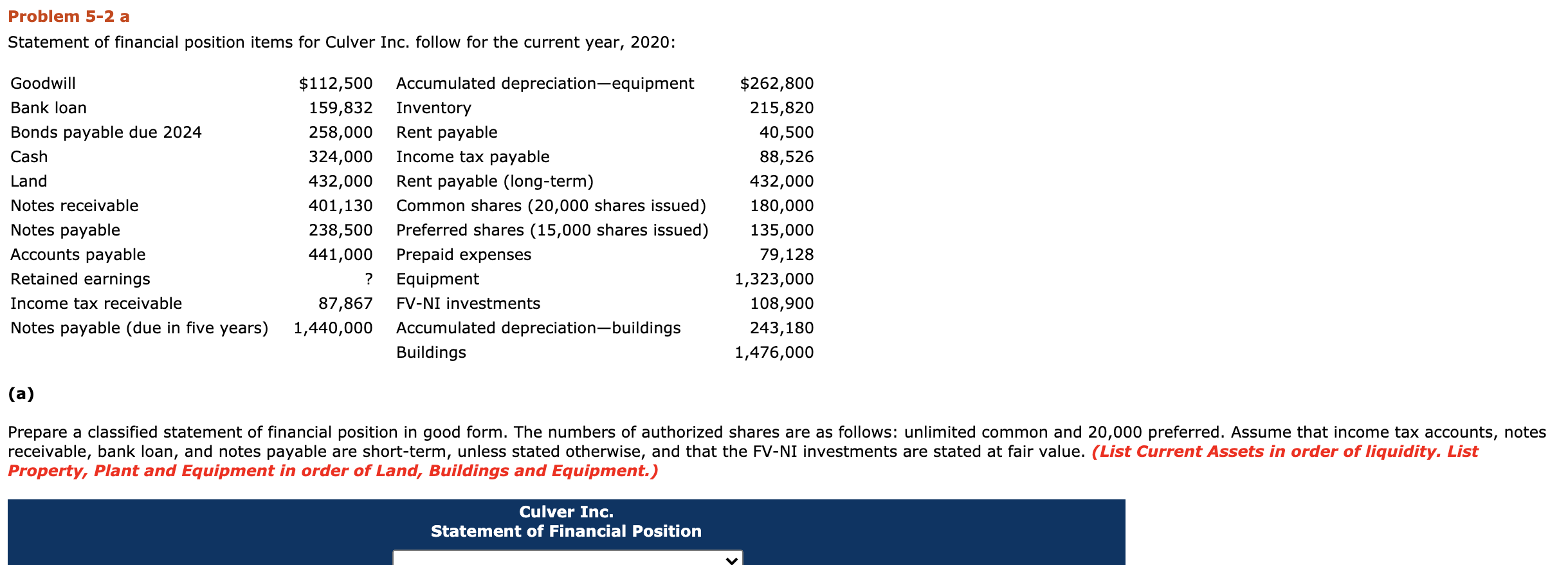

Question: Problem 5-2 a Statement of financial position items for Culver Inc. follow for the current year, 2020: Goodwill Bank loan Bonds payable due 2024 Cash

Problem 5-2 a Statement of financial position items for Culver Inc. follow for the current year, 2020: Goodwill Bank loan Bonds payable due 2024 Cash Land Notes receivable Notes payable Accounts payable Retained earnings Income tax receivable Notes payable (due in five years) $112,500 159,832 258,000 324,000 432,000 401,130 238,500 441,000 ? 87,867 1,440,000 Accumulated depreciation-equipment Inventory Rent payable Income tax payable Rent payable (long-term) Common shares (20,000 shares issued) Preferred shares (15,000 shares issued) Prepaid expenses Equipment FV-NI investments Accumulated depreciation-buildings Buildings $262,800 215,820 40,500 88,526 432,000 180,000 135,000 79,128 1,323,000 108,900 243,180 1,476,000 (a) Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: unlimited common and 20,000 preferred. Assume that income tax accounts, notes receivable, bank loan, and notes payable are short-term, unless stated otherwise, and that the FV-NI investments are stated at fair value. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.) Culver Inc. Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts