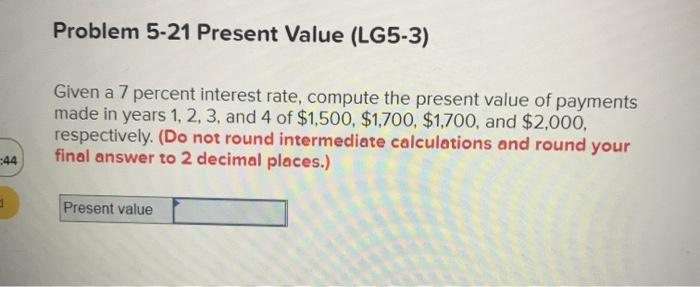

Question: Problem 5-21 Present Value (LG5-3) Given a 7 percent interest rate, compute the present value of payments made in years 1, 2, 3, and 4

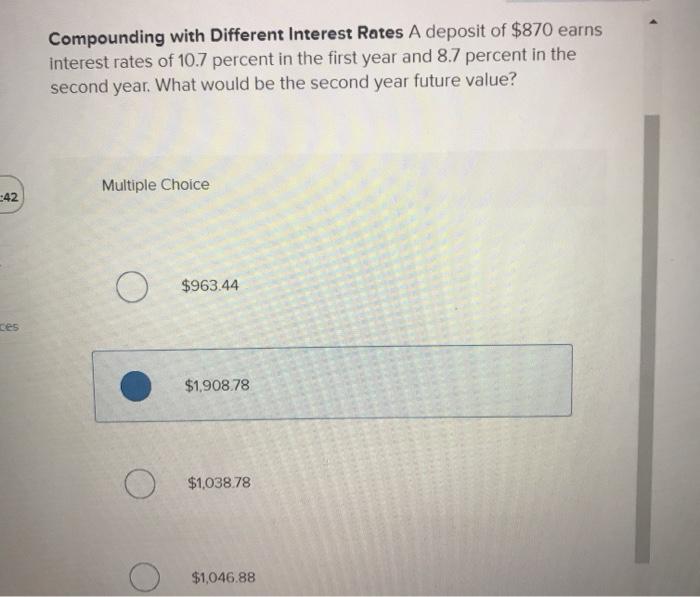

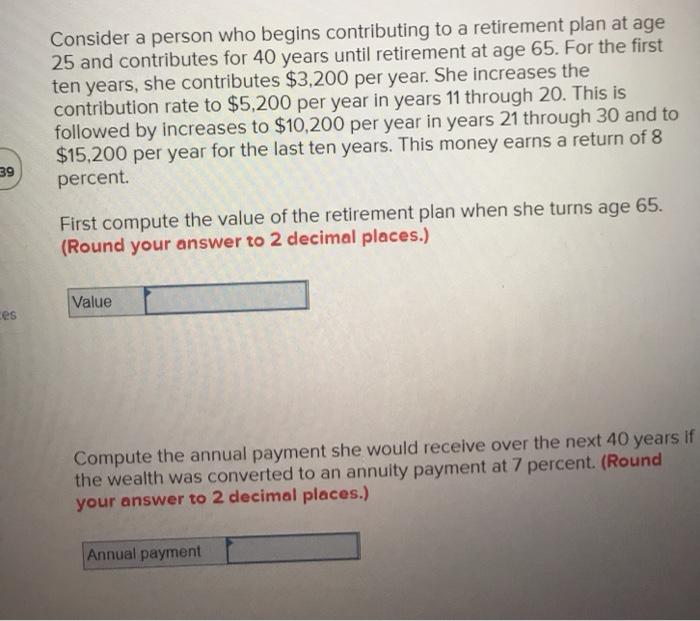

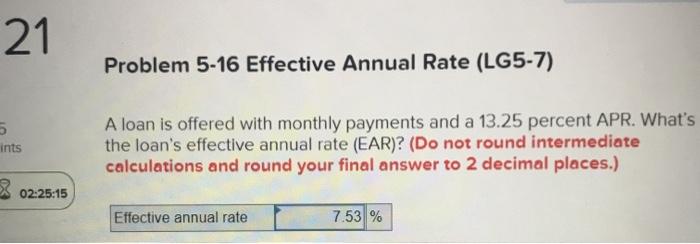

Problem 5-21 Present Value (LG5-3) Given a 7 percent interest rate, compute the present value of payments made in years 1, 2, 3, and 4 of $1,500, $1,700, $1,700, and $2,000, respectively. (Do not round intermediate calculations and round your final answer to 2 decimal places.) -:44 Present value Compounding with Different Interest Rates A deposit of $870 earns interest rates of 10.7 percent in the first year and 8.7 percent in the second year. What would be the second year future value? Multiple Choice 42 $963.44 res $1,908.78 $1,038.78 $1,046.88 Consider a person who begins contributing to a retirement plan at age 25 and contributes for 40 years until retirement at age 65. For the first ten years, she contributes $3,200 per year. She increases the contribution rate to $5,200 per year in years 11 through 20. This is followed by increases to $10,200 per year in years 21 through 30 and to $15,200 per year for the last ten years. This money earns a return of 8 percent. 39 First compute the value of the retirement plan when she turns age 65. (Round your answer to 2 decimal places.) Value ces Compute the annual payment she would receive over the next 40 years if the wealth was converted to an annuity payment at 7 percent. (Round your answer to 2 decimal places.) Annual payment 21 Problem 5-16 Effective Annual Rate (LG5-7) ints A loan is offered with monthly payments and a 13.25 percent APR. What's the loan's effective annual rate (EAR)? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 02:25:15 Effective annual rate 7.53%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts