Question: Problem 5-24 (Algorithmic) Interest (LO 5.8) Janet and James purchased their personal residence 15 years ago for $377,500. For the current year, they have an

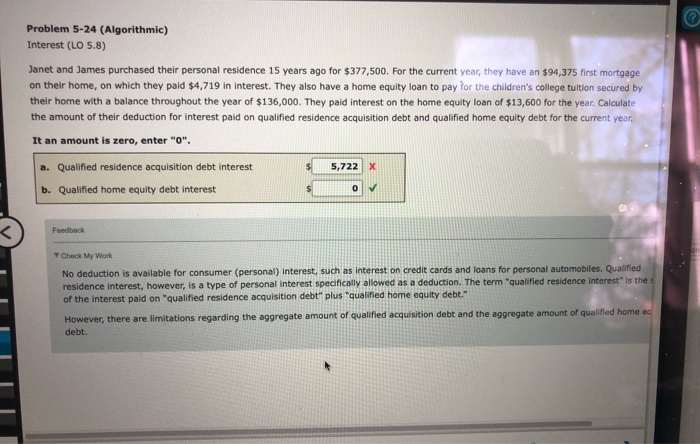

Problem 5-24 (Algorithmic) Interest (LO 5.8) Janet and James purchased their personal residence 15 years ago for $377,500. For the current year, they have an $94,375 first mortgage on their home, on which they paid $4,719 in interest. They also have a home equity loan to pay for the children's college tuition secured by their home with a balance throughout the year of $136,000. They paid interest on the home equity loan of $13,600 for the year. Calculate the amount of their deduction for interest paid on qualified residence acquisition debt and qualified home equity debt for the current year, It an amount is zero, enter "O". 5,722 X a. Qualified residence acquisition debt interest b. Qualified home equity debt interest Feedback Check My Work No deduction is available for consumer (personal) interest, such as interest on credit cards and loans for personal automobiles. Qualified residence interest, however, is a type of personal interest specifically allowed as a deduction. The term "qualified residence interest is the of the interest paid on qualified residence acquisition debt" plus qualified home equity debt. However, there are limitations regarding the aggregate amount of qualified acquisition debt and the aggregate amount of qualified home ed debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts