Question: Problem 5-26 (a) (LO. 1, 2, 3) On September 30, Marsh Corporation, a calendar year taxpayer, sold a parcel of land (basis of $320,000) for

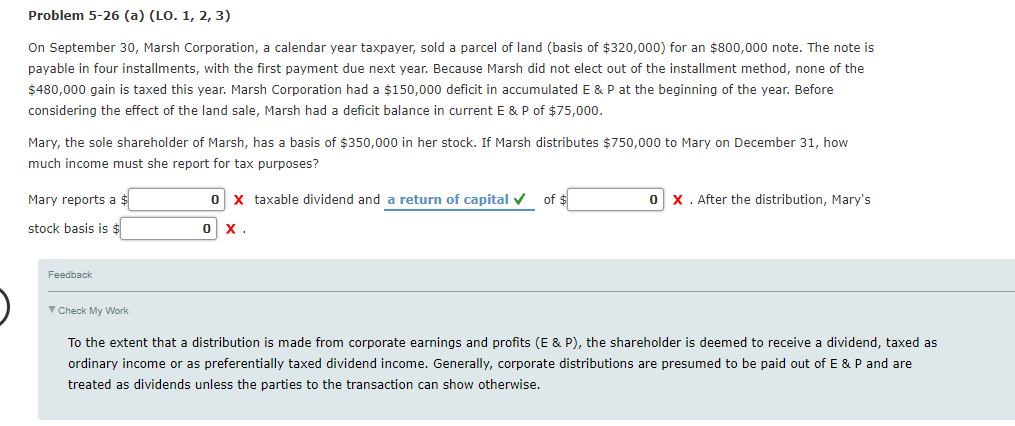

Problem 5-26 (a) (LO. 1, 2, 3) On September 30, Marsh Corporation, a calendar year taxpayer, sold a parcel of land (basis of $320,000) for an $800,000 note. The note is payable in four installments, with the first payment due next year. Because Marsh did not elect out of the installment method, none of the $480,000 gain is taxed this year. Marsh Corporation had a $150,000 deficit in accumulated E & P at the beginning of the year. Before considering the effect of the land sale, Marsh had a deficit balance in current E&P of $75,000 Mary, the sole shareholder of Marsh, has a basis of $350,000 in her stock. If Marsh distributes $750,000 to Mary on December 31, how much income must she report for tax purposes? Mary reports a 0 X taxable dividend and a return of capital of $ x . After the distribution, Mary's stock basis is Check My Work To the extent that a distribution is made from corporate earnings and profits (E & P), the shareholder is deemed to receive a dividend, taxed as ordinary income or as preferentially taxed dividend income. Generally, corporate distributions are presumed to be paid out of E & P and are treated as dividends unless the parties to the transaction can show otherwise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts