Question: Problem 5-2A (Part Level Submission) Latona Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger

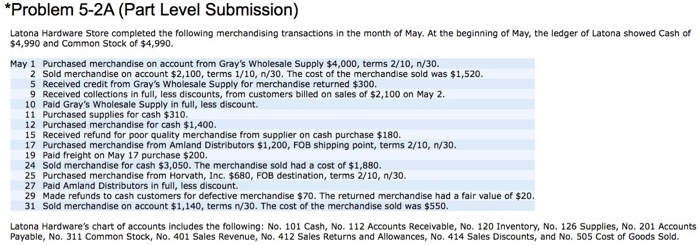

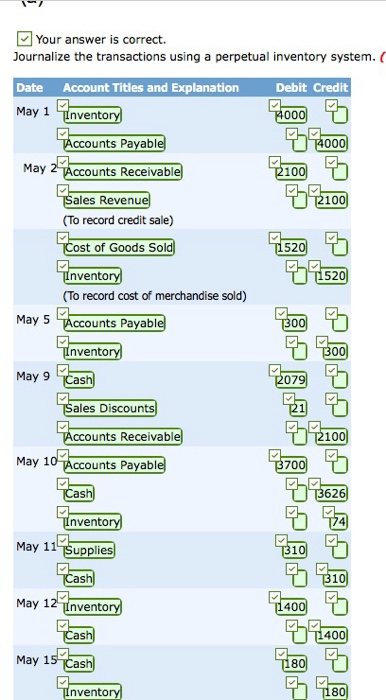

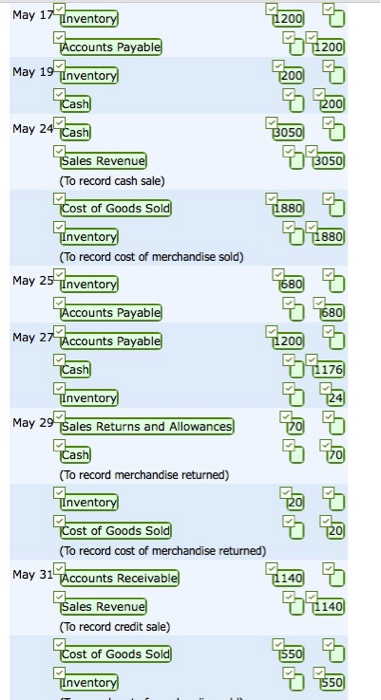

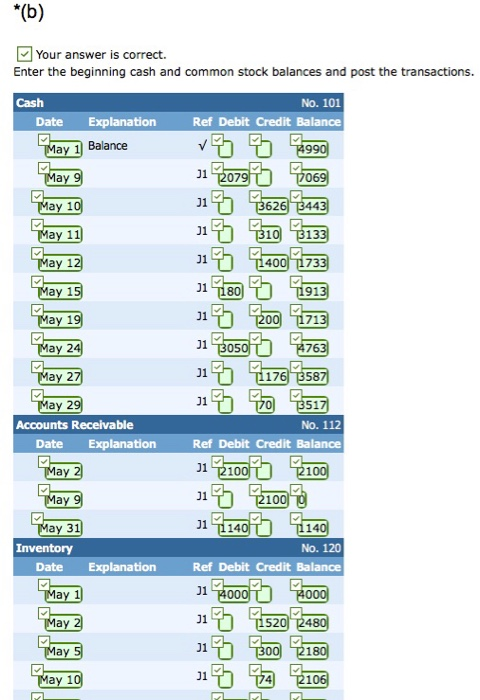

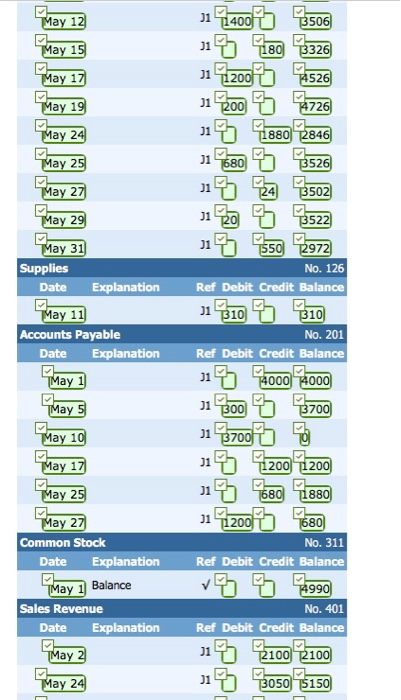

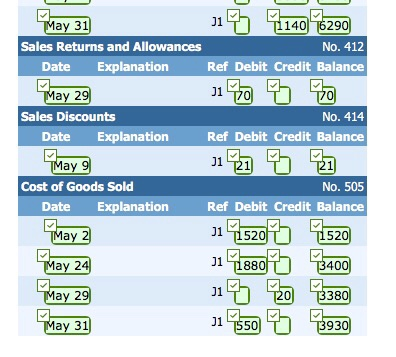

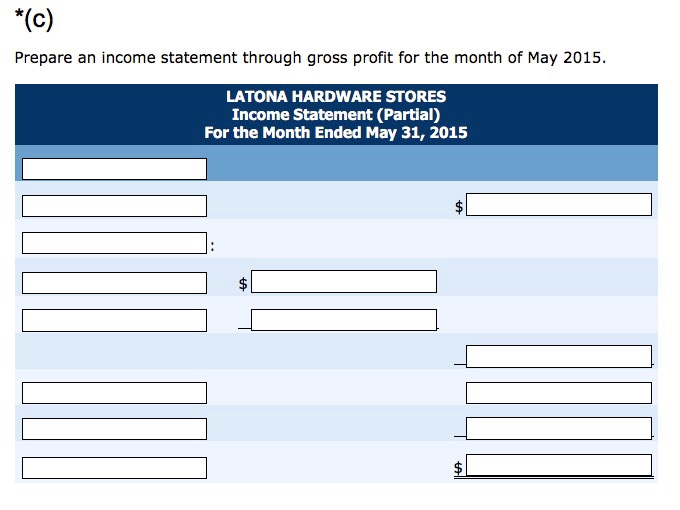

Problem 5-2A (Part Level Submission) Latona Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Latona showed Cash of $4,990 and Common Stock of $4,990. May 1 Purchased merchandise on account from Gray's Wholesale Supply $4,000, terms 2/10, n/30. 2 Sold merchandise on account $2,100, terms 1/10, n/30. The cost of the merchandise sold was $1,520. 5 Received credit from Gray's Wholesale Supply for merchandise returned $300. 9 Received collections in full, less discounts, from customers billed on sales of $2,100 on May 2 10 Paid Gray's Wholesale Supply in full, less discount. 11 Purchased supplies for cash $310 12 Purchased merchandise for cash $1,400. 15 Received refund for poor quality merchandise from supplier on cash purchase $180 17 Purchased merchandise from Amland Distributors $1,200, FOB shipping point, terms 2/10, n/30. 19 Paid freight on May 17 purchase $200 24 Sold merchandise for cash $3,050. The merchandise sold had a cost of $1,880 25 Purchased merchandise from Horvath, Inc. $680, FOB destination, terms 2/10, n/30. 27 Paid Amland Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise $70. The returned merchandise had a fair value of $20 31 Sold merchandise on account $1,140, terms ny30. The cost of the merchandise sold was $550 Latona Hardware's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No. 311 Common Stock, No. 401 Sales Revenue, No. 412 Sales Returns and Alowances, No. 414 Sales Discounts, and No. S05 Cost of Goods Sold Your answer is correct. Journalize the transactions using a perpetual inventory system. ( Date Account Titles and Explanation Debit Credit ay TInven ounts Payabl May ounts Receivable 10 ales Revenue 100 (To record credit sale) st of Goods Sol 52 52 nven (To record cost of merchandise sold) May 5 ounts Payabl nvento 2079 ) May 9 ales Discoun 2100 17001 ) ounts Receivable May 1 0 Accounts Payabl Cash nvento ) May 11 TSupplies May 12 Tinven May 1 nven May 17 nvento 2 1200 ccounts Payabl May 19 Tnvento May 24 (To record cash sale) ost of Goods Sold nvento (To record cost of merchandise sold) May 25 Invento ccounts Payabl May 27 TAccounts Payab 1178 Cash nvento 29 Sales Returns and Allowances May 2 Coasn (To record merchandise returned) nvento To record cost of merchandise returned) May 31 Accounts Receivab 1140 To record credit sale) nvento Your answer is correct. Enter the beginning cash and common stock balances and post the transactions. Cash No. 101 Date Explanation Ref Debit Credit Balance 950 ay 1 Balanoe J1 J1 J1 JI 62 1 305 J1 51 ay 2 No. 112 Accounts Receivable Date Explanation Ref Debit Credit Balance 01 1 T114 ay 31 No. 120 Ref Debit Credit Balance Date Explanation 01 ay 1 J1 01 ay 31 No. 126 Ref Debit Credit Balance Date Explanation Accounts Payable Date Explanation Ref Debit Credit Balance ay 1 200 1200 ay ay 2 Common Stock Date Explanation ay 1 Balance Date Explanation Ref Debit Credit Balance Sales Revenue No. 401 Ref Debit Credit Balance 0 ay 24 ay 31 140 6290 Sales Returns and Allowances No. 412 Date Explanation Ref Debit Credit Balance ay 2 Sales Discounts No. 414 ate Explanation Ref Debit Credit Balance J1-21 ay Cost of Goods Sold No. 505 Date Explanation Ref Debit Credit Balance ay ay 24 ay 29 ay 31 J11880 B400 380 1 550 930 Prepare an income statement through gross profit for the month of May 2015 LATONA HARDWARE STORES Income Statement (Partial) For the Month Ended May 31, 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts