Question: Problem 5-30 (Algorithmic) (LO. 1, 3) Sparrow Corporation is a calendar year taxpayer. At the beginning of the current yeac, Sparrow has accumuiated E a

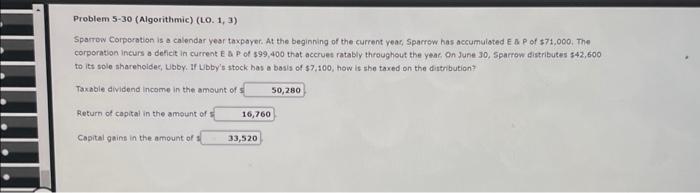

Problem 5-30 (Algorithmic) (LO. 1, 3) Sparrow Corporation is a calendar year taxpayer. At the beginning of the current yeac, Sparrow has accumuiated E a p of 571,000 . The corporation incurs a defict in current E a P of $99,400 that aceruet ratably throughout the year, On June 30 , Sparrow distributes 542,600 to its sole sharehoidec, Ubby. Wf Lbby's stock has a bosis of 57,100 , how is the tared on the distribution? Taxable dividend income in the amount of 1 Return of capital in the amount of 3 Capital gaint in the amount of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts