Question: Problem 5.31 @LO 7,08 Cost flow assumptions-FIFO and LIFO using a periodic system Mower-Blower Sales Co. started business on January 20, 2019. Products sold were

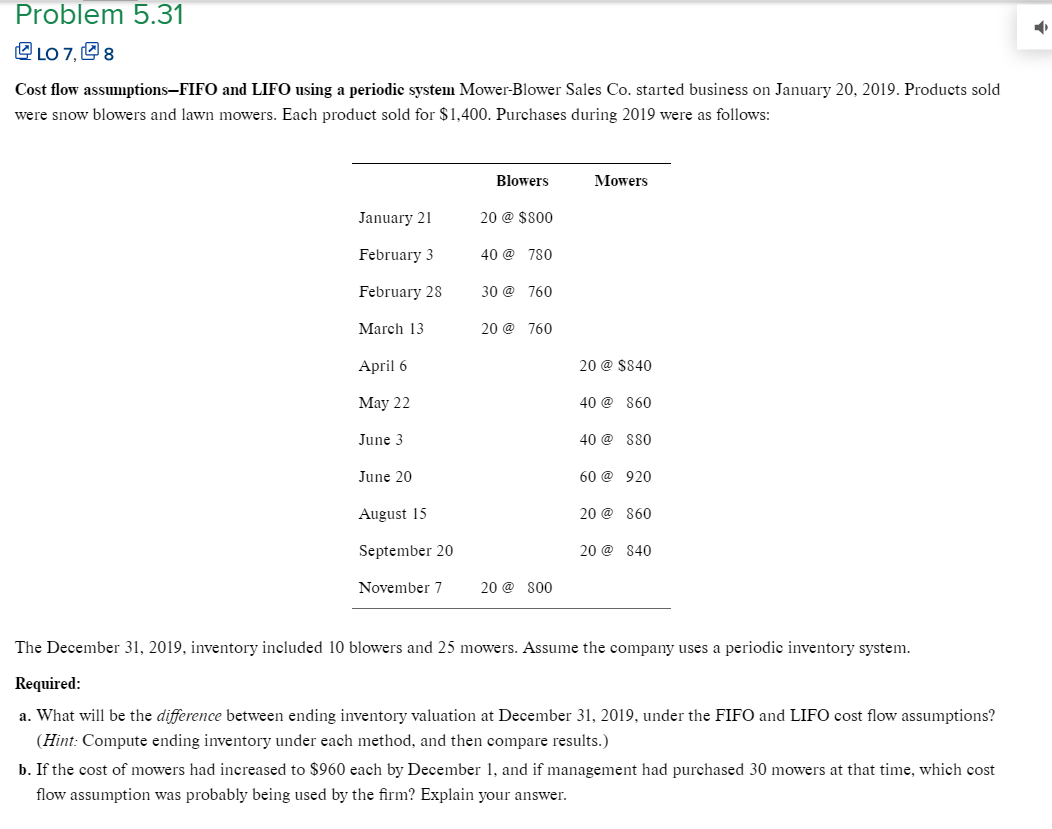

Problem 5.31 @LO 7,08 Cost flow assumptions-FIFO and LIFO using a periodic system Mower-Blower Sales Co. started business on January 20, 2019. Products sold were snow blowers and lawn mowers. Each product sold for $1,400. Purchases during 2019 were as follows: Blowers Mowers January 21 20 @ $800 February 3 40 @ 780 February 28 30 @ 760 20 @ 760 March 13 April 6 20 @ $840 May 22 40 @ 860 June 3 40 @ 880 June 20 60 @ 920 August 15 20 @ 860 September 20 20 @ 840 November 7 20 @ 800 The December 31, 2019, inventory included 10 blowers and 25 mowers. Assume the company uses a periodic inventory system. Required: a. What will be the difference between ending inventory valuation at December 31, 2019, under the FIFO and LIFO cost flow assumptions? (Hint: Compute ending inventory under each method, and then compare results.) b. If the cost of mowers had increased to $960 each by December 1, and if management had purchased 30 mowers at that time, which cost flow assumption was probably being used by the firm? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts