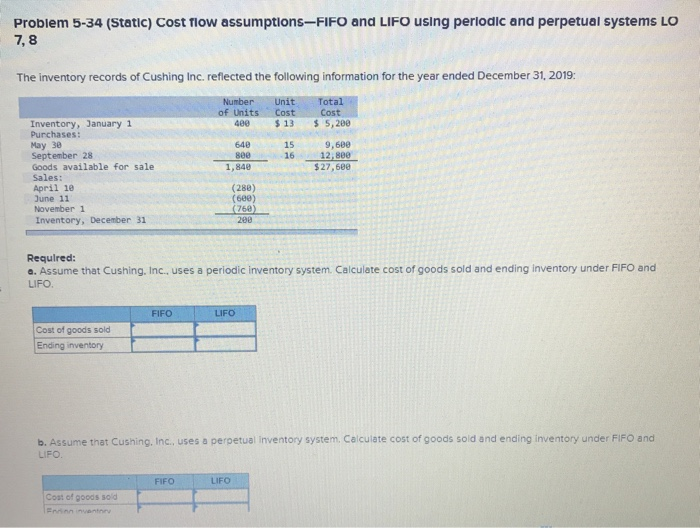

Question: Problem 5-34 (Static) Cost flow assumptions-FIFO and LIFO using periodic and perpetual systems LO 7,8 The inventory records of Cushing Inc. reflected the following information

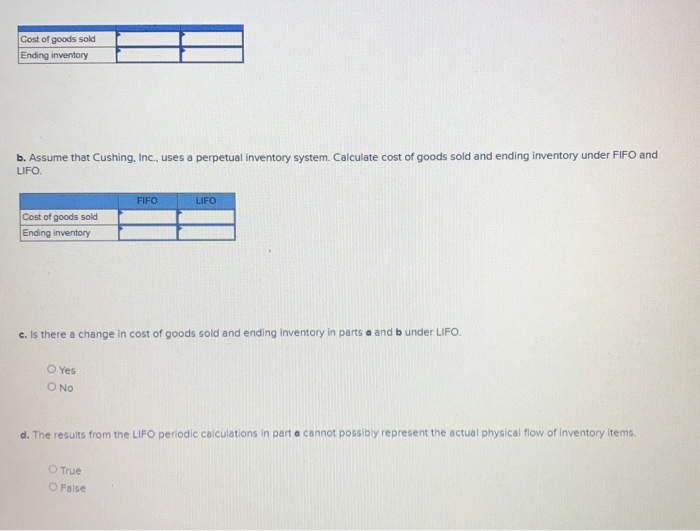

Problem 5-34 (Static) Cost flow assumptions-FIFO and LIFO using periodic and perpetual systems LO 7,8 The inventory records of Cushing Inc. reflected the following information for the year ended December 31, 2019: Number of Units 400 Unit Cost Total Cost $ 5,200 Inventory, January 1 Purchases: $ 13 May 30 640 800 1,840 15 16 9,600 12,800 $27,600 September 28 Goods available for sale Sales: April 1e June 11 November 1 Inventory, December 31 (280) (600) (760 200 Required: a. Assume that Cushing, Inc., uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO FIFO LIFO Cost of goods sold Ending inventory b. Assume that Cushing, Inc., uses a perpetual Inventory system. Calculate cost of goods sold and ending Inventory under FIFO and LIFO FIFO LIFO Cost of goods sold nath Cost of goods sold Ending inventory b. Assume that Cushing, Inc., uses a perpetual inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO FIFO LIFO Cost of goods sold Ending inventory c. Is there a change in cost of goods sold and ending inventory in parts a and b under LIFO. Yes O NO d. The results from the LIFO periodic calculations in part o cannot possibly represent the actual physical flow of inventory items True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts