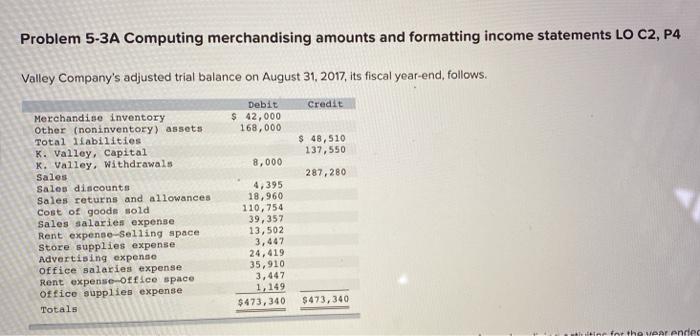

Question: Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows.

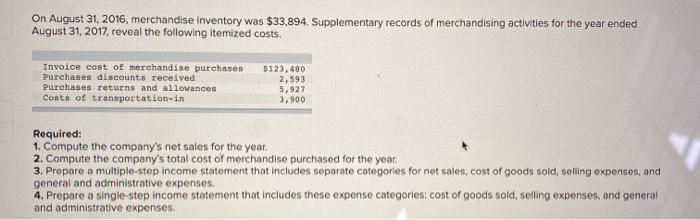

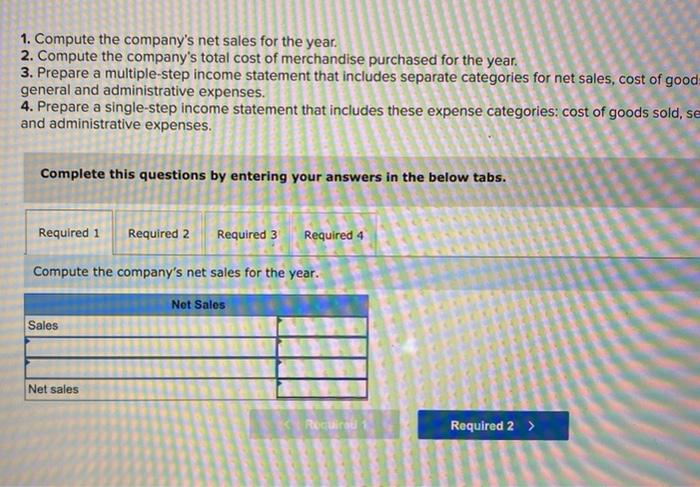

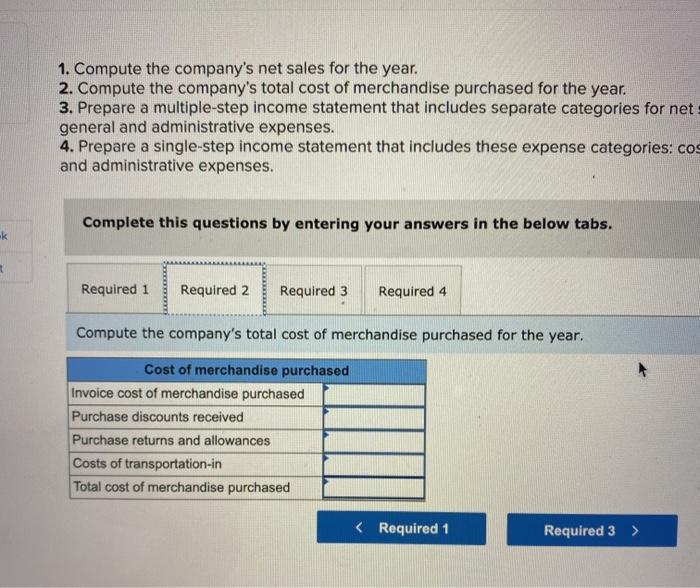

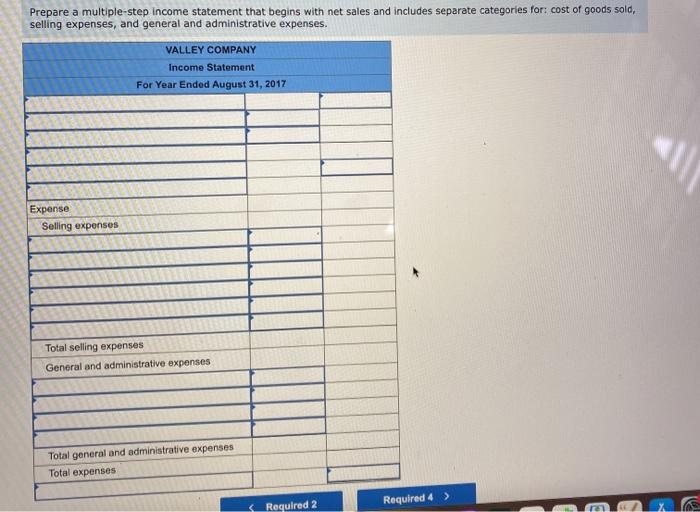

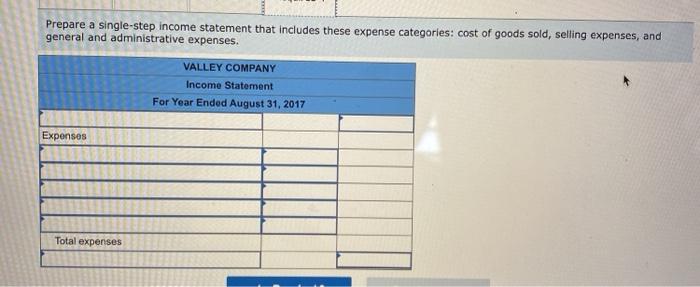

Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows. Credit Debit $ 42,000 168,000 $ 48, 510 137,550 8,000 287,280 Merchandise inventory Other (noninventory) assets Total liabilities K. Valley, Capital X. Valley. Withdrawals Sales Salon discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense office salaries expense Rent expense-Office space Office supplies expense Totals 4,395 18,960 110,754 39,357 13,502 3,447 24,419 35,910 3,447 1,149 $473,340 $ 473,340 for the wrence On August 31, 2016, merchandise inventory was $33,894. Supplementary records of merchandising activities for the year ended August 31, 2017, reveal the following itemized costs. Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation in $123, 480 2,593 5,927 3,900 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of good general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, se and administrative expenses. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Compute the company's net sales for the year. Net Sales Sales Net sales Recurou 1 Required 2 > 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net! general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cos and administrative expenses. Complete this questions by entering your answers in the below tabs. k Required 1 Required 2 Required 3 Required 4 Compute the company's total cost of merchandise purchased for the year. Cost of merchandise purchased Invoice cost of merchandise purchased Purchase discounts received Purchase returns and allowances Costs of transportation-in Total cost of merchandise purchased Prepare a multiple-step income statement that begins with net sales and includes separate categories for: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Expense Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses Required 4 ) Required 2 Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Expenses Total expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts