Question: * Problem 5-4 (algorithmic) E Question Help Credit Suisse Geneva. Andreas Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives

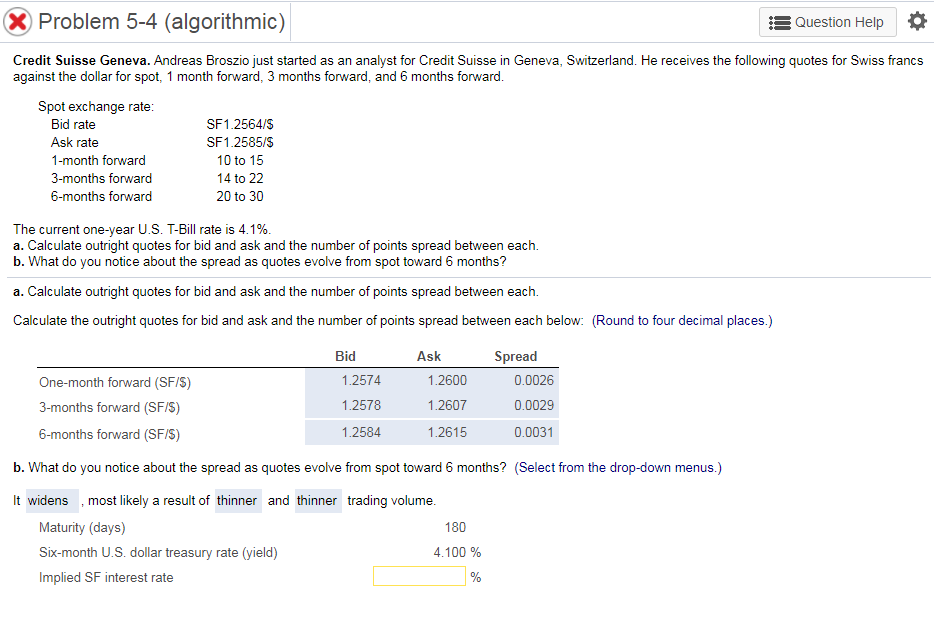

* Problem 5-4 (algorithmic) E Question Help Credit Suisse Geneva. Andreas Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following quotes for Swiss francs against the dollar for spot, 1 month forward, 3 months forward, and 6 months forward. Spot exchange rate: Bid rate Ask rate 1-month forward 3-months forward 6-months forward SF1.2564/$ SF1.2585/S 10 to 15 14 to 22 20 to 30 The current one-year U.S. T-Bill rate is 4.1%. a. Calculate outright quotes for bid and ask and the number of points spread between each. b. What do you notice about the spread as quotes evolve from spot toward 6 months? a. Calculate outright quotes for bid and ask and the number of points spread between each. Calculate the outright quotes for bid and ask and the number of points spread between each below: (Round to four decimal places.) One-month forward (SF/$) 3-months forward (SF/S) Bid Spread 1.2574 1.26000.0026 1.2578 1.2607 0.0029 1.2584 1.2615 0.0031 6-months forward (SF/S) b. What do you notice about the spread as quotes evolve from spot toward 6 months? (Select from the drop-down menus.) It widens , most likely a result of thinner and thinner trading volume. Maturity (days) 180 Six-month U.S. dollar treasury rate (yield) 4.100 % Implied SF interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts