Question: Problem 5-4 AlwaysRain Irrigation, Inc., would like to determine capacity requirements for the next four years. Currently two production lines are in place for making

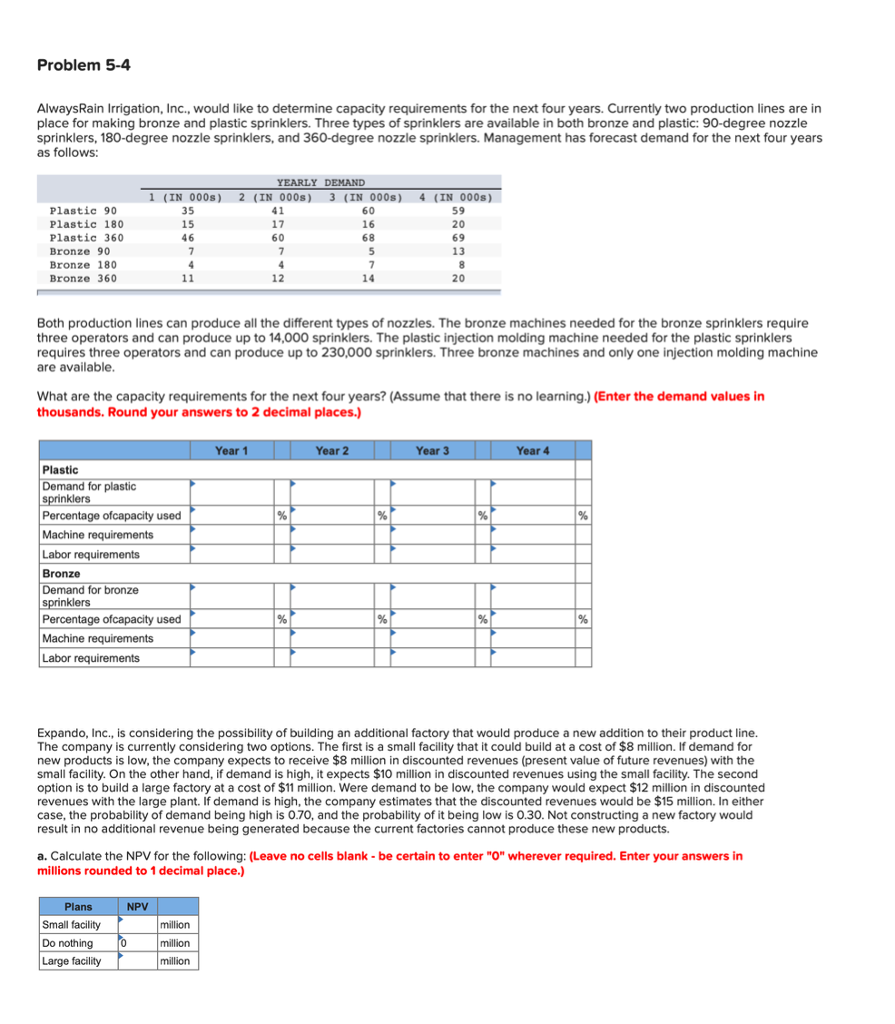

Problem 5-4 AlwaysRain Irrigation, Inc., would like to determine capacity requirements for the next four years. Currently two production lines are in place for making bronze and plastic sprinklers. Three types of sprinklers are available in both bronze and plastic: 90-degree nozzle sprinklers, 180-degree nozzle sprinklers, and 360-degree nozzle sprinklers. Management has forecast demand for the next four years as follows: YEARLY DEMAND 1 (IN 000s) 2 (IN 000s) 3 (IN 000s) 4 (IN 000s) Plastic 90 Plastic 180 Plastic 360 Bronze 90 Bronze 180 Bronze 360 35 15 46 41 17 60 60 16 68 59 20 69 13 12 14 20 Both production lines can produce all the different types of nozzles. The bronze machines needed for the bronze sprinklers require three operators and can produce up to 14,000 sprinklers. The plastic injection molding machine needed for the plastic sprinklers requires three operators and can produce up to 230,000 sprinklers. Three bronze machines and only one injection molding machine are available What are the capacity requirements for the next four years? (Assume that there is no learning.) (Enter the demand values in thousands. Round your answers to 2 decimal places) Year 1 Year 2 Year 3 Year 4 Plastic Demand for plastic rinklers Percentage ofcapacity used Machine requirements Labor requirements Bronze Demand for bronze nklers Percentage ofcapacity used Machine requirements Labor requirements Expando, Inc., is considering the possibility of building an additional factory that would produce a new addition to their product line The company is currently considering two options. The first is a small facility that it could build at a cost of $8 million. If demand for new products is low, the company expects to receive $8 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $10 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $11 million. Were demand to be low, the company would expect $12 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $15 million. In either case, the probability of demand being high is 0.70, and the probability of it being low is 0.30. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. a. Calculate the NPV for the following: (Leave no cells blank-be certain to enter "O" wherever required. Enter your answers in millions rounded to 1 decimal place.) Plans Small facility Do nothing Large facility million million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts