Question: Problem 5-40 (Algorithmic) (LO. 2) Abbey spent the last 55 days of 2021 in a nursing home. The cost of the services provided to her

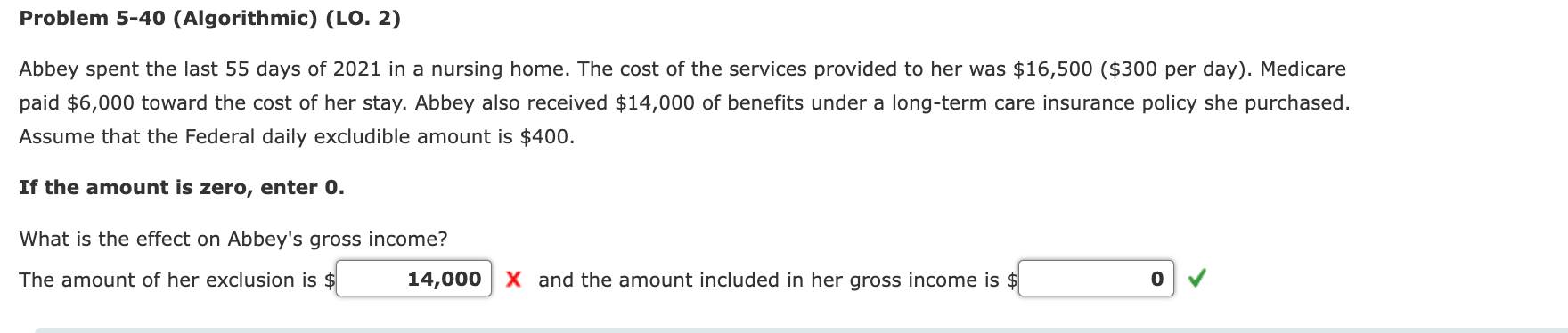

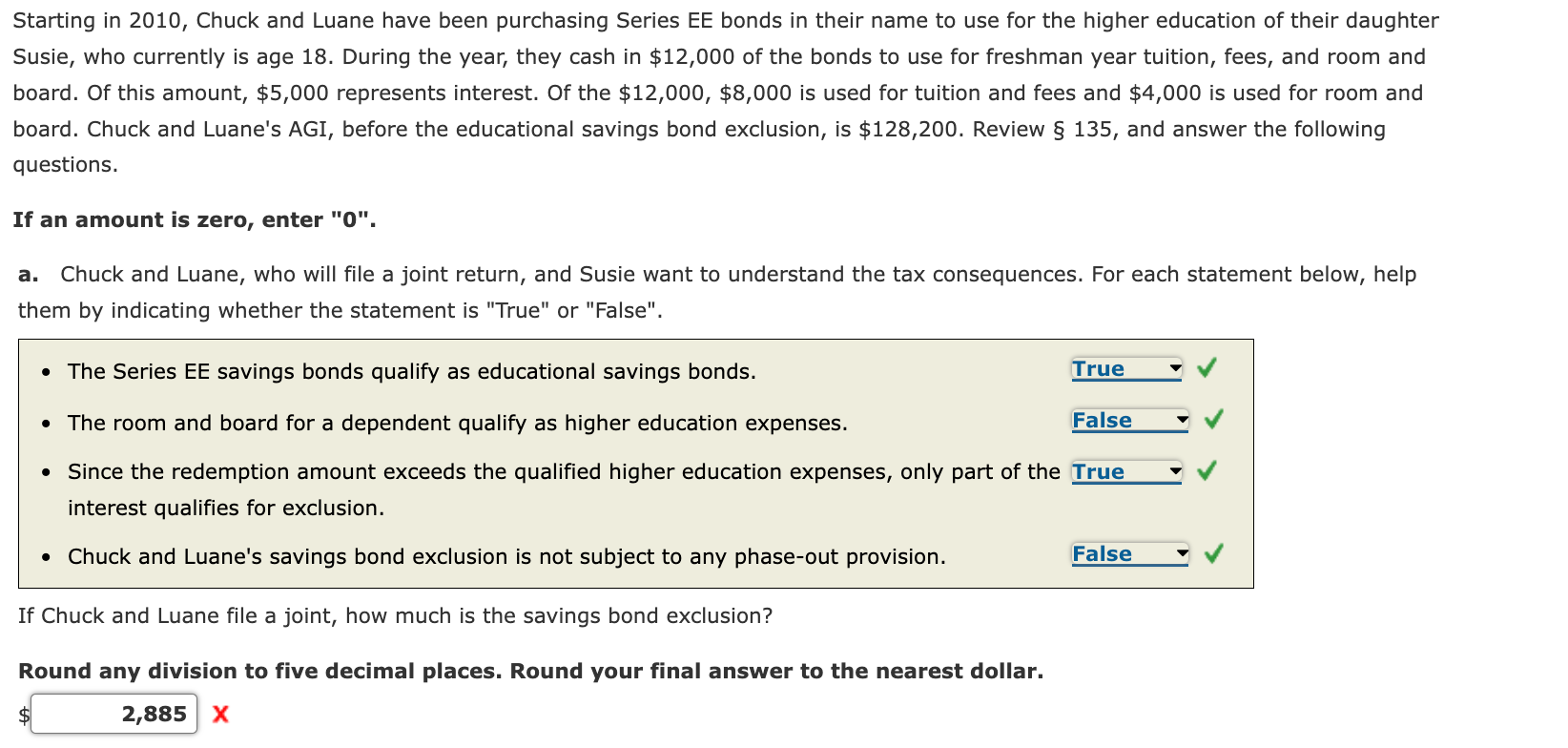

Problem 5-40 (Algorithmic) (LO. 2) Abbey spent the last 55 days of 2021 in a nursing home. The cost of the services provided to her was $16,500 ($300 per day). Medicare paid $6,000 toward the cost of her stay. Abbey also received $14,000 of benefits under a long-term care insurance policy she purchased. Assume that the Federal daily excludible amount is $400. If the amount is zero, enter 0. What is the effect on Abbey's gross income? The amount of her exclusion is $ 14,000 X and the amount included in her gross income is $ 0 Starting in 2010, Chuck and Luane have been purchasing Series EE bonds in their name to use for the higher education of their daughter Susie, who currently is age 18. During the year, they cash in $12,000 of the bonds to use for freshman year tuition, fees, and room and board. Of this amount, $5,000 represents interest. Of the $12,000, $8,000 is used for tuition and fees and $4,000 is used for room and board. Chuck and Luane's AGI, before the educational savings bond exclusion, is $128,200. Review 135, and answer the following questions. If an amount is zero, enter "0". a. Chuck and Luane, who will file a joint return, and Susie want to understand the tax consequences. For each statement below, help them by indicating whether the statement is "True" or "False". The Series EE savings bonds qualify as educational savings bonds. True The room and board for a dependent qualify as higher education expenses. False Since the redemption amount exceeds the qualified higher education expenses, only part of the True interest qualifies for exclusion. Chuck and Luane's savings bond exclusion is not subject to any phase-out provision. False If Chuck and Luane file a joint, how much is the savings bond exclusion? Round any division to five decimal places. Round your final answer to the nearest dollar. $ 2,885 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts