Question: Problem 5-40 (Algorithmic) (LO. 2) Edna spent the last 90 days of 2018 in a nursing home. The cost of the services provided to her

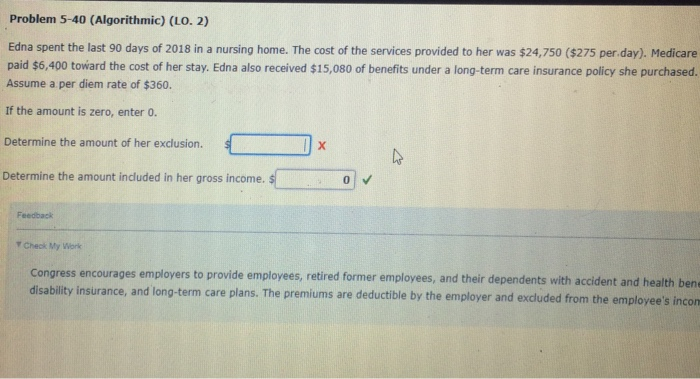

Problem 5-40 (Algorithmic) (LO. 2) Edna spent the last 90 days of 2018 in a nursing home. The cost of the services provided to her was $24,750 ($275 per.day). Medicare paid $6,400 toward the cost of her stay. Edna also received $15,080 of benefits under a long-term care insurance policy she purchased. Assume a per diem rate of $360. If the amount is zero, enter 0. Determine the amount of her exclusion. Determine the amount included in her gross income. Feedback Y Check My Work Congress encourages employers to provide employees, retired former employees, and their dependents with accident and health ben disability insurance, and long-term care plans. The premiums are deductible by the employer and excluded from the employee's incon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts