Question: Problem 5-42 (Algorithmic) (LO. 7) On February 20, 2017, Javier Sanchez purchased and placed in service a 7-year class asset costing $698,000 for use in

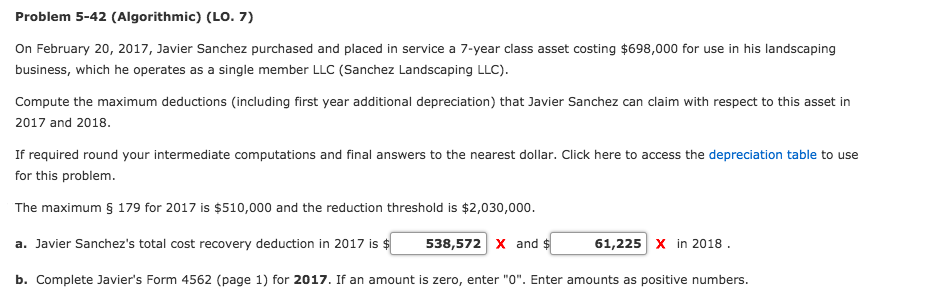

Problem 5-42 (Algorithmic) (LO. 7) On February 20, 2017, Javier Sanchez purchased and placed in service a 7-year class asset costing $698,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). Compute the maximum deductions (including first year additional depreciation) that Javier Sanchez can claim with respect to this asset in 2017 and 2018 If required round your intermediate computations and final answers to the nearest dollar. Click here to access the depreciation table to use for this problem. The maximum 9 179 for 2017 is $510,000 and the reduction threshold is $2,030,000 a. Javier Sanchez's total cost recovery deduction in 2017 is b. Complete Javier's Form 4562 (page 1) for 2017. If an amount is zero, enter "O". Enter amounts as positive numbers 538,572X and 61,225 Xin 2018 Problem 5-42 (Algorithmic) (LO. 7) On February 20, 2017, Javier Sanchez purchased and placed in service a 7-year class asset costing $698,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). Compute the maximum deductions (including first year additional depreciation) that Javier Sanchez can claim with respect to this asset in 2017 and 2018 If required round your intermediate computations and final answers to the nearest dollar. Click here to access the depreciation table to use for this problem. The maximum 9 179 for 2017 is $510,000 and the reduction threshold is $2,030,000 a. Javier Sanchez's total cost recovery deduction in 2017 is b. Complete Javier's Form 4562 (page 1) for 2017. If an amount is zero, enter "O". Enter amounts as positive numbers 538,572X and 61,225 Xin 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts