Question: Problem 5-43 (LO. 2, 4) Bertha is considering taking an early retirement offered by her employer. She would receive $3,000 per month, indexed for premiums

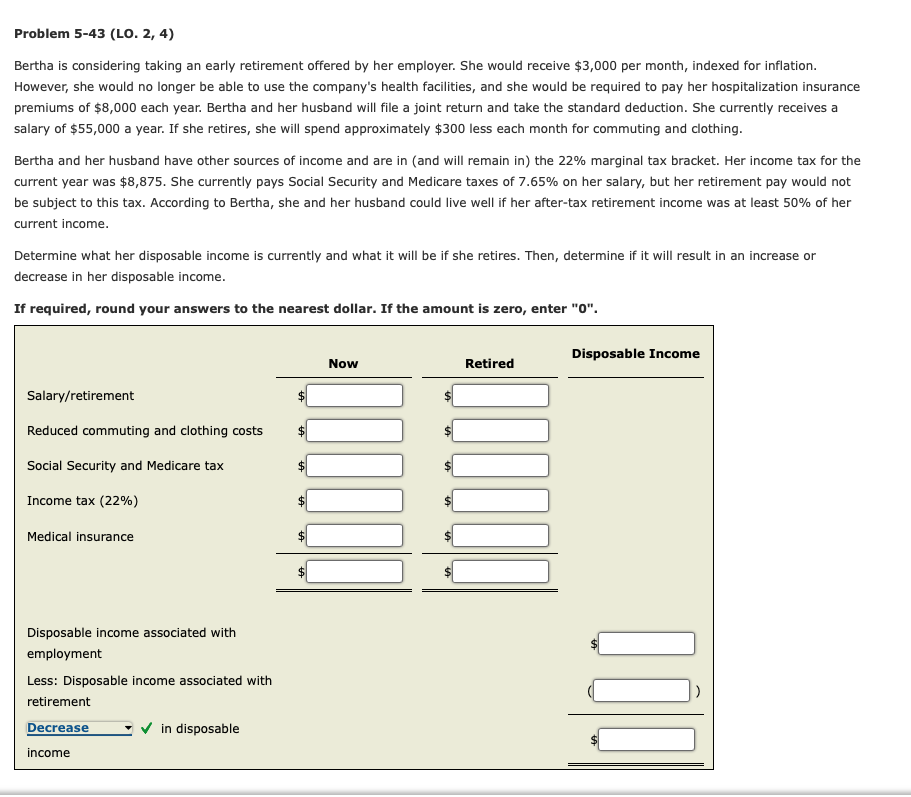

Problem 5-43 (LO. 2, 4) Bertha is considering taking an early retirement offered by her employer. She would receive $3,000 per month, indexed for premiums of $8,000 each year. Bertha and her husband will file a joint return and take the standard dection. She currently salary of $55,000 a year. If she retires, she will spend approximately $300 less each month for commuting and clothing. Bertha and her husband have other sources of income and are in (and will remain in) the 22% marginal tax bracket. Her income tax be subject to this tax. According to Bertha, she and her husband could live well if her after-tax retirement income was at 50% of current income. Determine what her disposable income is currently and what it will be if she retires. Then, determine if it will result increase or decrease in her disposable income. If required, round your answers to the nearest dollar. If the amount is zero, enter " 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts