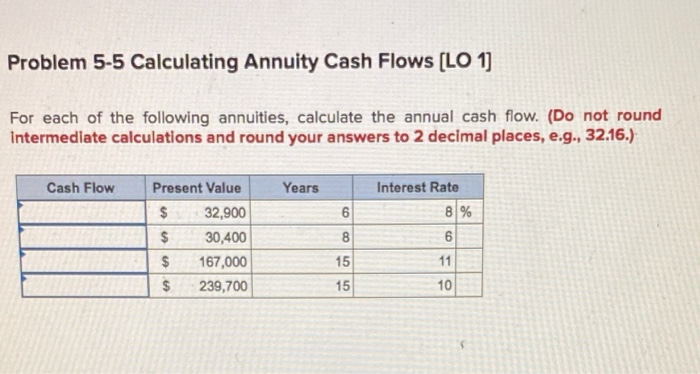

Question: Problem 5-5 Calculating Annuity Cash Flows [LO 1) For each of the following annuities, calculate the annual cash flow. (Do not round intermediate calculations and

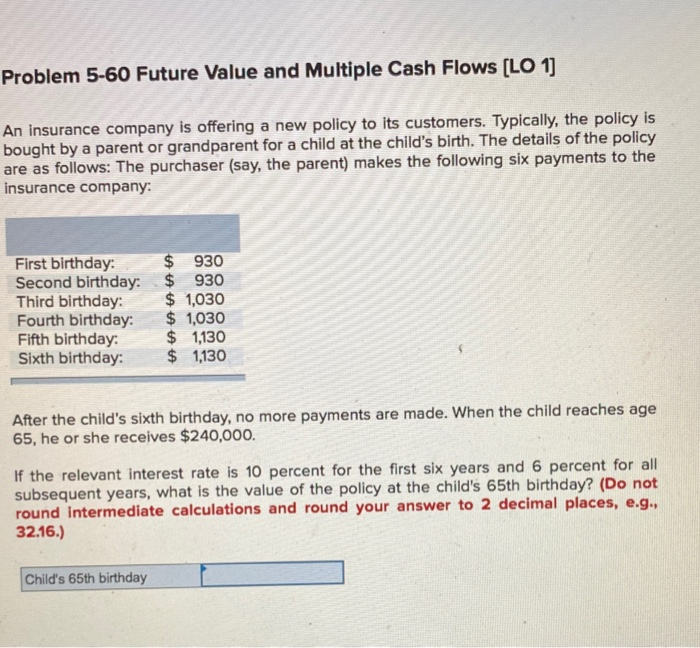

Problem 5-5 Calculating Annuity Cash Flows [LO 1) For each of the following annuities, calculate the annual cash flow. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Cash Flow Years Present Value $ 32,900 $ 30,400 $ 167,000 $ 239,700 6 8 15 Interest Rate 8 % 6 11 15 10 Problem 5-60 Future Value and Multiple Cash Flows (LO 1] An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 930 $ 930 $ 1,030 $ 1,030 $ 1,130 $ 1,130 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $240,000. If the relevant interest rate is 10 percent for the first six years and 6 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Child's 65th birthday

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts