Question: Problem 5-5A (Algo) Compare the direct write-off method to the allowance method (LO5-3, 5-6) In an effort to boost sales in the current year, Arnold's

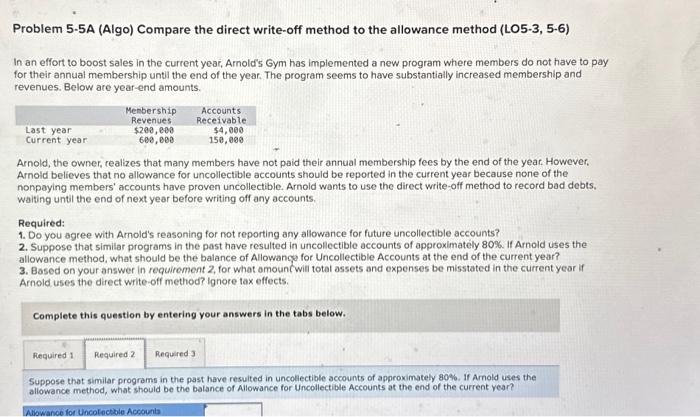

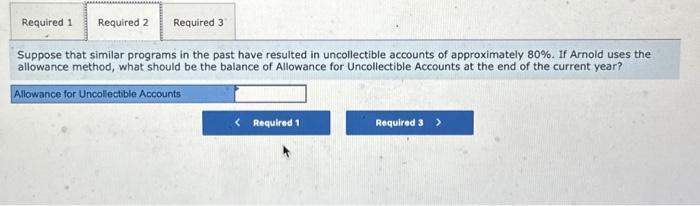

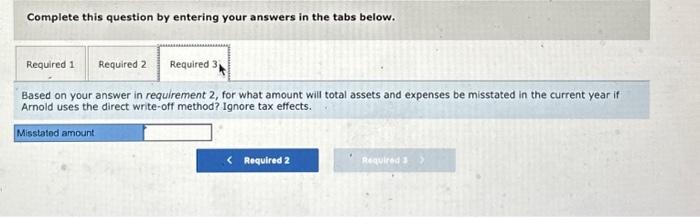

Problem 5-5A (Algo) Compare the direct write-off method to the allowance method (LO5-3, 5-6) In an effort to boost sales in the current year, Arnold's Gym has implemented a new program where members do not have to pa for their annual membership until the end of the year. The program seems to have substantially increased membership and revenues. Below are year-end amounts. Arnold, the owner, realizes that many members have not paid their annual membership fees by the end of the year. However, Arnold believes that no allowance for uncollectible accounts should be reported in the current year because none of the nonpaying members' accounts have proven uncollectible. Arnold wants to use the direct write-off method to record bad debts, waiting until the end of next year before writing off any accounts. Required: 1. Do you agree with Arnold's reasoning for not reporting any allowance for future uncollectible accounts? 2. Suppose that similar programs in the past have resulted in uncollectible accounts of approximately 80%. If Arnold uses the allowance method, what should be the balance of Allowance for Uncollectible Accounts at the end of the current year? 3. Based on your answer in requiroment 2, for what amounc will total assets and expenses be misstated in the current yeor if Arnold uses the direct write-off method? Ignore tax effects. Complete this question by entering your answers in the tabs below. Suppose that similar programs in the past have resulted in uncoliectible accounts of approximately 80%. If Amold uses the allowance method, what should be the balance of Allowance for Uncollectible Accounts at the end of the current year? Suppose that similar programs in the past have resulted in uncollectible accounts of approximately 80%. If Arnold uses the allowance method, what should be the balance of Allowance for Uncollectible Accounts at the end of the current year? Complete this question by entering your answers in the tabs below. Based on your answer in requirement 2, for what amount will total assets and expenses be misstated in the current year if Arnold uses the direct write-off method? Ignore tax effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts