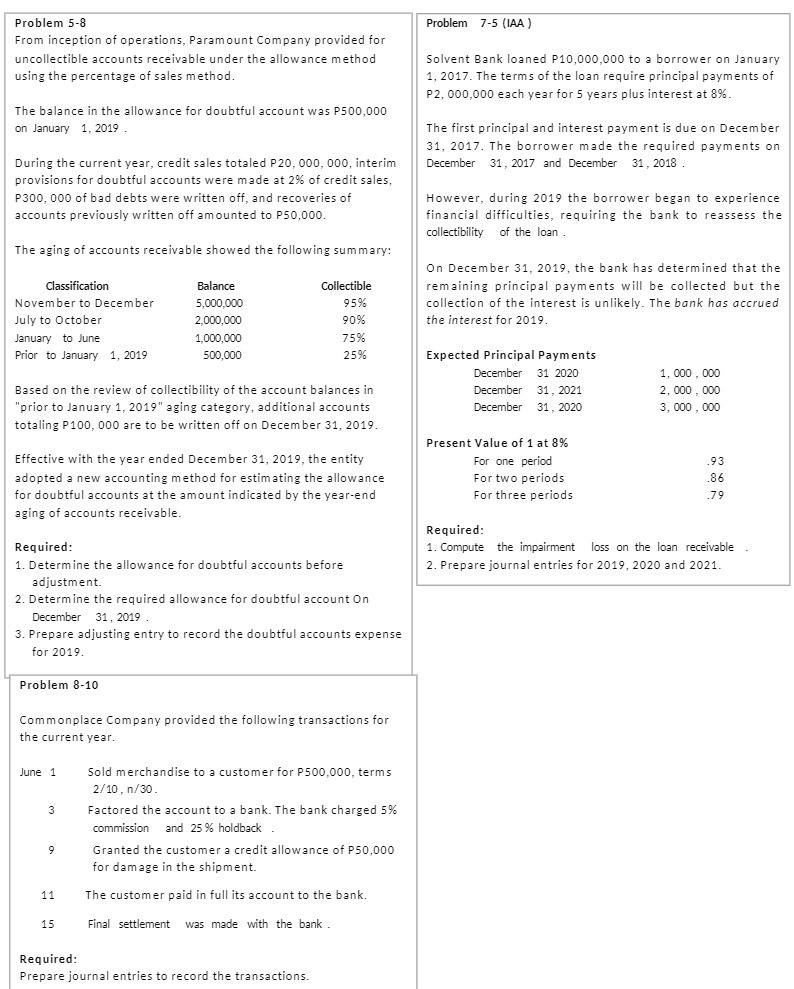

Question: Problem 5-8 Problem 7-5 (IAA ) From inception of operations, Paramount Company provided for uncollectible accounts receivable under the allowance method Solvent Bank loaned P10,000,000

Problem 5-8 Problem 7-5 (IAA ) From inception of operations, Paramount Company provided for uncollectible accounts receivable under the allowance method Solvent Bank loaned P10,000,000 to a borrower on January using the percentage of sales method. 1, 2017. The terms of the loan require principal payments of P2, 000,000 each year for 5 years plus interest at 8%%. The balance in the allowance for doubtful account was P500,000 on January 1, 2019 . The first principal and interest payment is due on December 31, 2017. The borrower made the required payments on During the current year, credit sales totaled P20, 000, 000, interim December 31, 2017 and December 31 , 2018 . provisions for doubtful accounts were made at 2%% of credit sales, P300, 000 of bad debts were written off, and recoveries of However, during 2019 the borrower began to experience accounts previously written off amounted to P50,000. financial difficulties, requiring the bank to reassess the collectibility of the loan The aging of accounts receivable showed the following summary: On December 31, 2019, the bank has determined that the Classification Balance Collectible remaining principal payments will be collected but the November to December 5,000,000 95% collection of the interest is unlikely. The bank has accrued July to October 2,000,000 90% the interest for 2019. January to June 1,000,000 75% Prior to January 1, 2019 500,000 25% Expected Principal Payments December 31 2020 1, 000 , 000 Based on the review of collectibility of the account balances in December 31 , 2021 2, 000 , 000 'prior to January 1, 2019" aging category, additional accounts December 31 , 2020 3, 000 , 000 totaling P100, 000 are to be written off on December 31, 2019. Present Value of 1 at 8% Effective with the year ended December 31, 2019, the entity For one period 93 adopted a new accounting method for estimating the allowance For two periods .86 for doubtful accounts at the amount indicated by the year-end For three periods 79 aging of accounts receivable. Required: Required: 1. Compute the impairment loss on the loan receivable 1. Determine the allowance for doubtful accounts before 2. Prepare journal entries for 2019, 2020 and 2021. adjustment. 2. Determine the required allowance for doubtful account On December 31, 2019 3. Prepare adjusting entry to record the doubtful accounts expense for 2019. Problem 8-10 Commonplace Company provided the following transactions for the current year. June 1 Sold merchandise to a customer for P500,000, terms 2/10, n/30. 3 Factored the account to a bank. The bank charged 5% commission and 25% holdback Granted the customer a credit allowance of P50,000 for damage in the shipment. 11 The customer paid in full its account to the bank. 15 Final settlement was made with the bank . Required: Prepare journal entries to record the transactions