Question: Problem 6 - 1 2 Taxes and project NPV Suppose that Sudbury Mechanical Drifters is proposing to invest $ 3 0 . 0 million in

Problem Taxes and project NPV

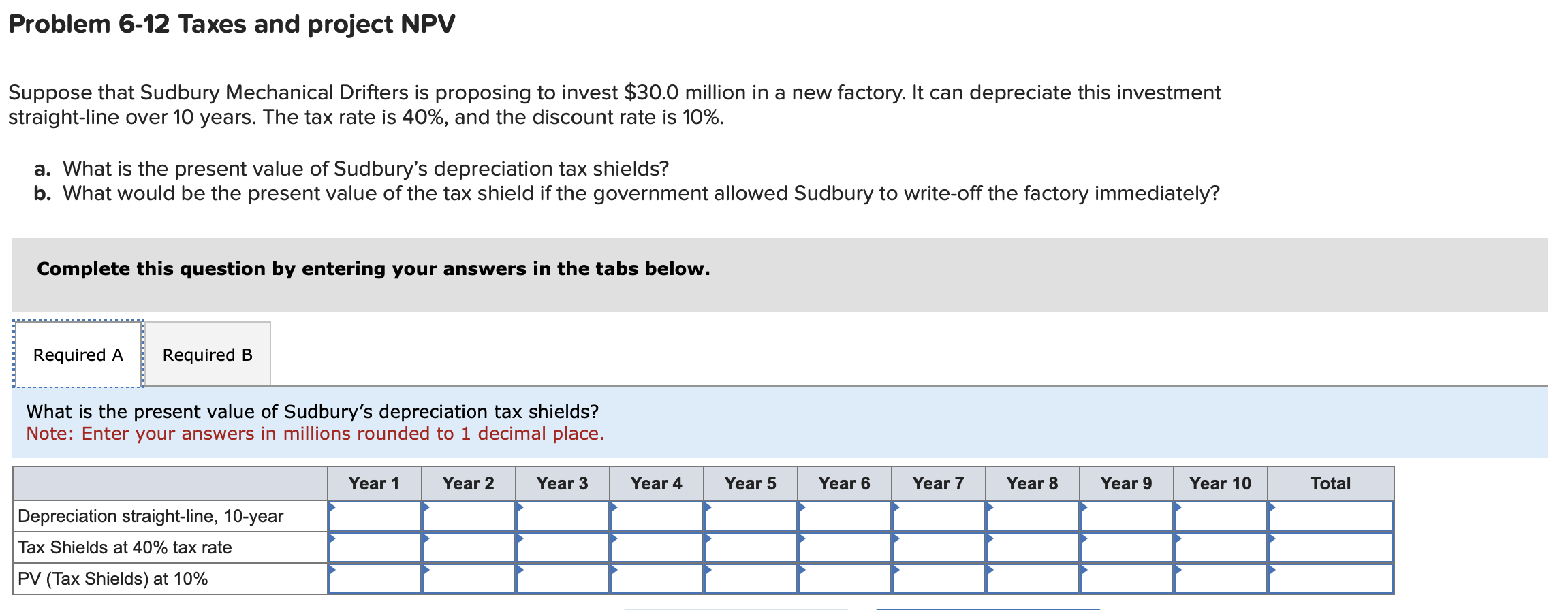

Suppose that Sudbury Mechanical Drifters is proposing to invest $ million in a new factory. It can depreciate this investment

straightline over years. The tax rate is and the discount rate is

a What is the present value of Sudbury's depreciation tax shields?

b What would be the present value of the tax shield if the government allowed Sudbury to writeoff the factory immediately?

Complete this question by entering your answers in the tabs below.

What is the present value of Sudbury's depreciation tax shields?

Note: Enter your answers in millions rounded to decimal place.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock