Question: Problem 6 - 1 6 Comparing Mutually Exclusive Projects Hagar Industrial Systems Company ( HISC ) is trying to decide between two different conveyor belt

Problem Comparing Mutually Exclusive Projects

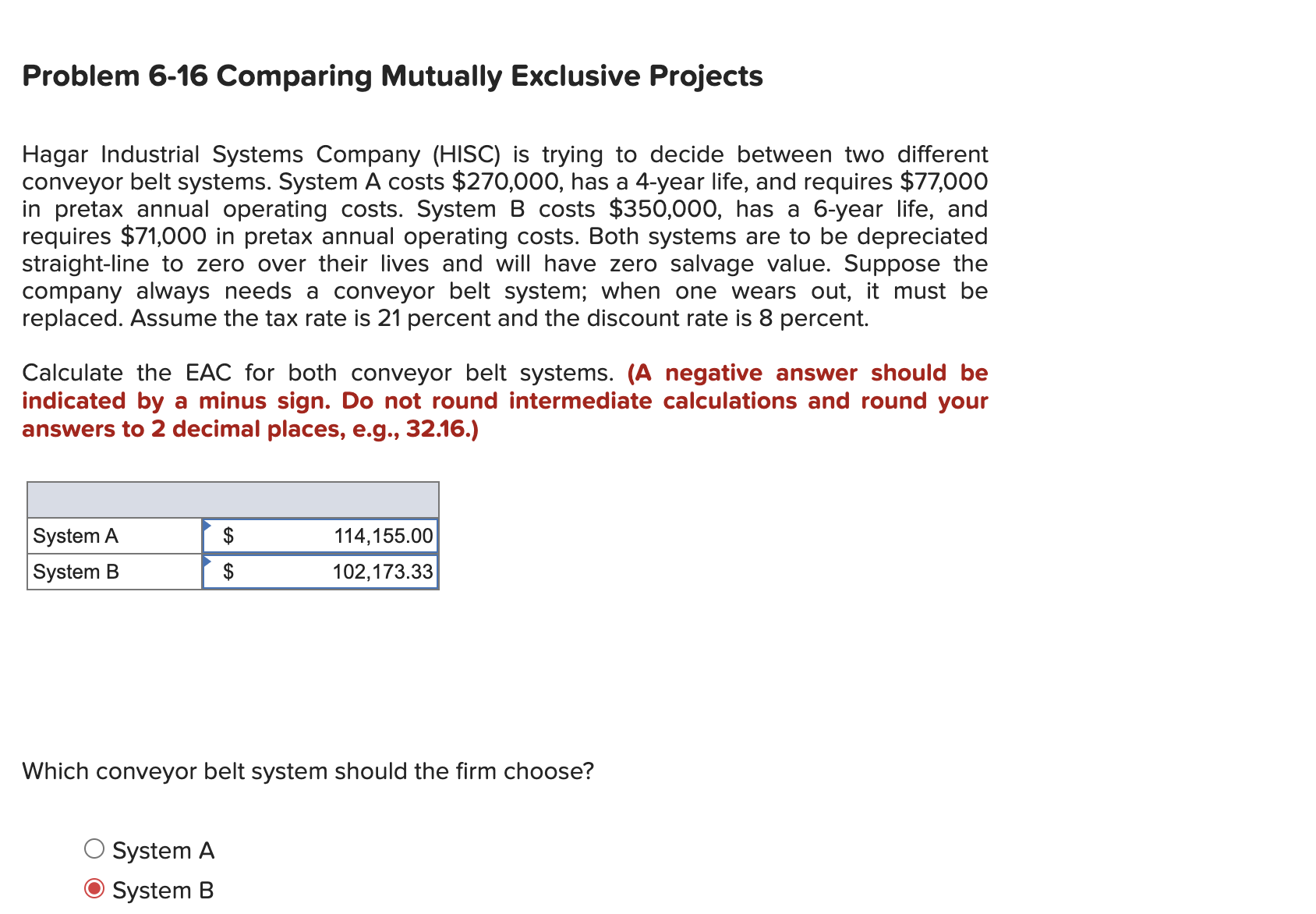

Hagar Industrial Systems Company HISC is trying to decide between two different

conveyor belt systems. System A costs $ has a year life, and requires $

in pretax annual operating costs. System B costs $ has a year life, and

requires $ in pretax annual operating costs. Both systems are to be depreciated

straightline to zero over their lives and will have zero salvage value. Suppose the

company always needs a conveyor belt system; when one wears out, it must be

replaced. Assume the tax rate is percent and the discount rate is percent.

Calculate the EAC for both conveyor belt systems. A negative answer should be

indicated by a minus sign. Do not round intermediate calculations and round your

answers to decimal places, eg

Which conveyor belt system should the firm choose?

System A

System B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock