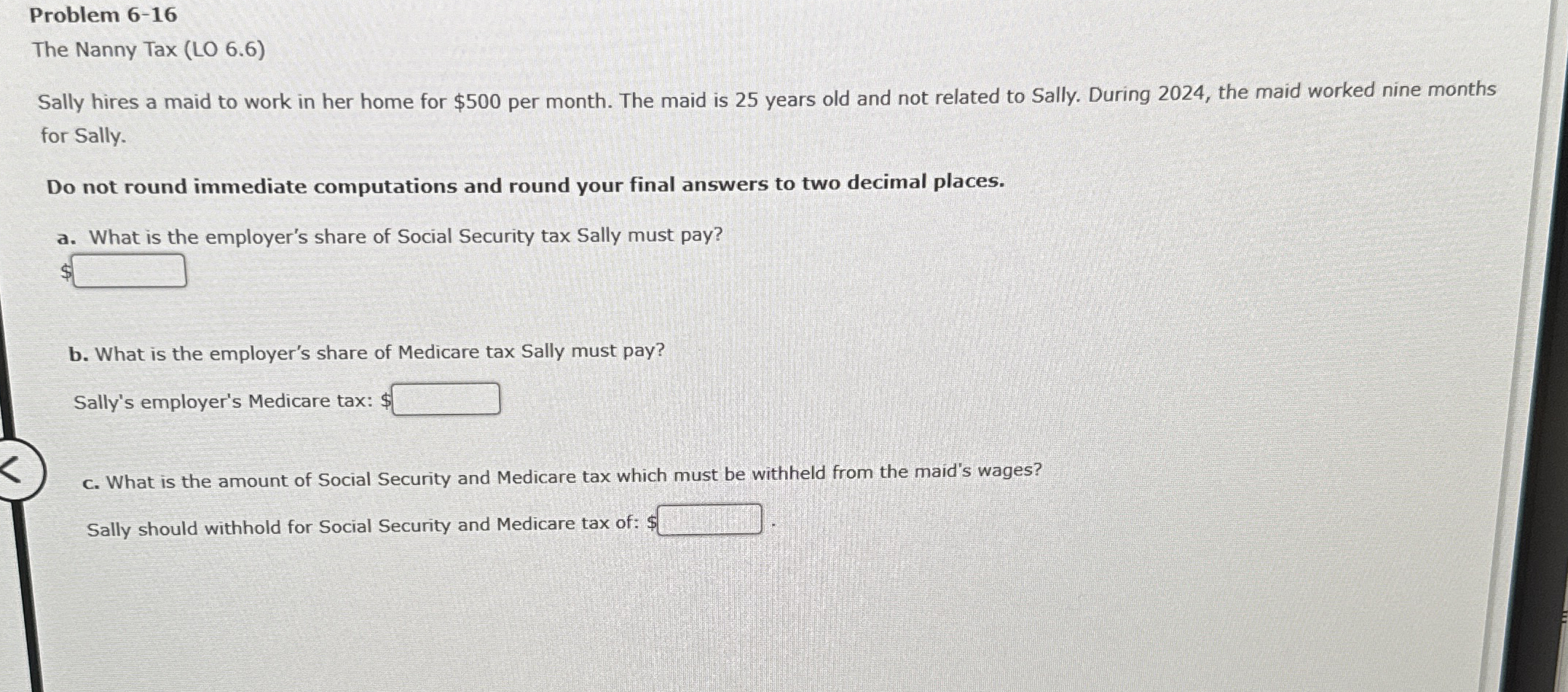

Question: Problem 6 - 1 6 The Nanny Tax ( LO 6 . 6 ) Sally hires a maid to work in her home for $

Problem

The Nanny Tax LO

Sally hires a maid to work in her home for $ per month. The maid is years old and not related to Sally. During the maid worked nine months for Sally.

Do not round immediate computations and round your final answers to two decimal places.

a What is the employer's share of Social Security tax Sally must pay?

$

b What is the employer's share of Medicare tax Sally must pay?

Sally's employer's Medicare tax:

c What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages?

Sally should withhold for Social Security and Medicare tax of: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock