Question: Problem 6 - 1 7 Asset valuation and risk. Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of

Problem

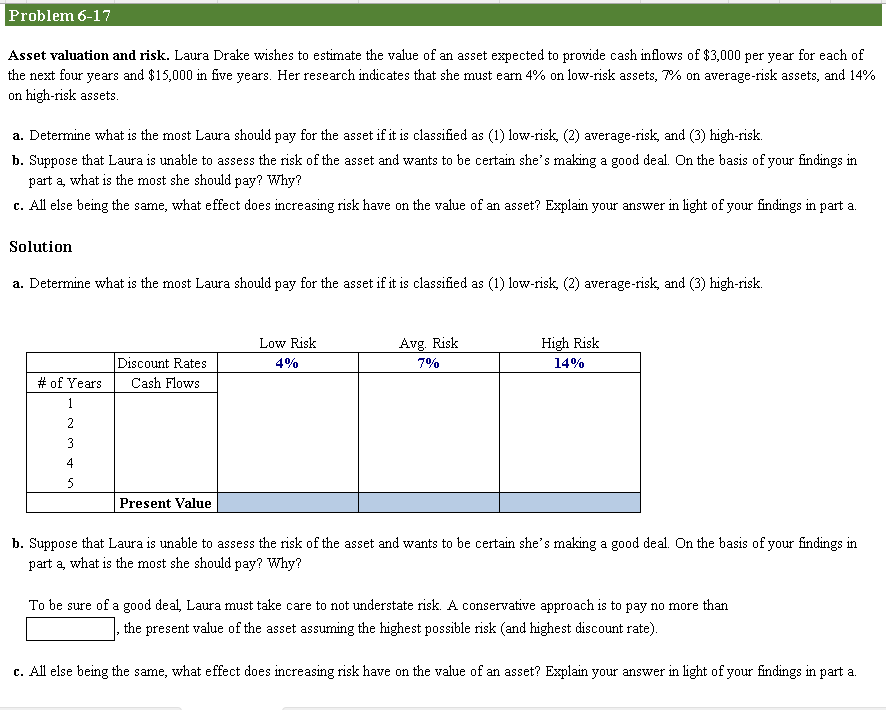

Asset valuation and risk. Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $ per year for each of the next four years and $ in five years. Her research indicates that she must earn on lowrisk assets, on averagerisk assets, and on highrisk assets.

a Determine what is the most Laura should pay for the asset if it is classified as lowrisk, averagerisk, and highrisk.

b Suppose that Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a what is the most she should pay? Why?

c All else being the same, what effect does increasing risk have on the value of an asset? Explain your answer in light of your findings in part a

Solution

a Determine what is the most Laura should pay for the asset if it is classified as lowrisk, averagerisk, and highrisk.

b Suppose that Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a what is the most she should pay? Why?

To be sure of a good deal, Laura must take care to not understate risk. A conservative approach is to pay no more than the present value of the asset assuming the highest possible risk and highest discount rate

c All else being the same, what effect does increasing risk have on the value of an asset? Explain your answer in light of your findings in part a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock