Question: Problem 6 - 1 7 Project NPV United Pigpen ( UP ) is considering a proposal to manufacture high protein hog feed. The project would

Problem Project NPV

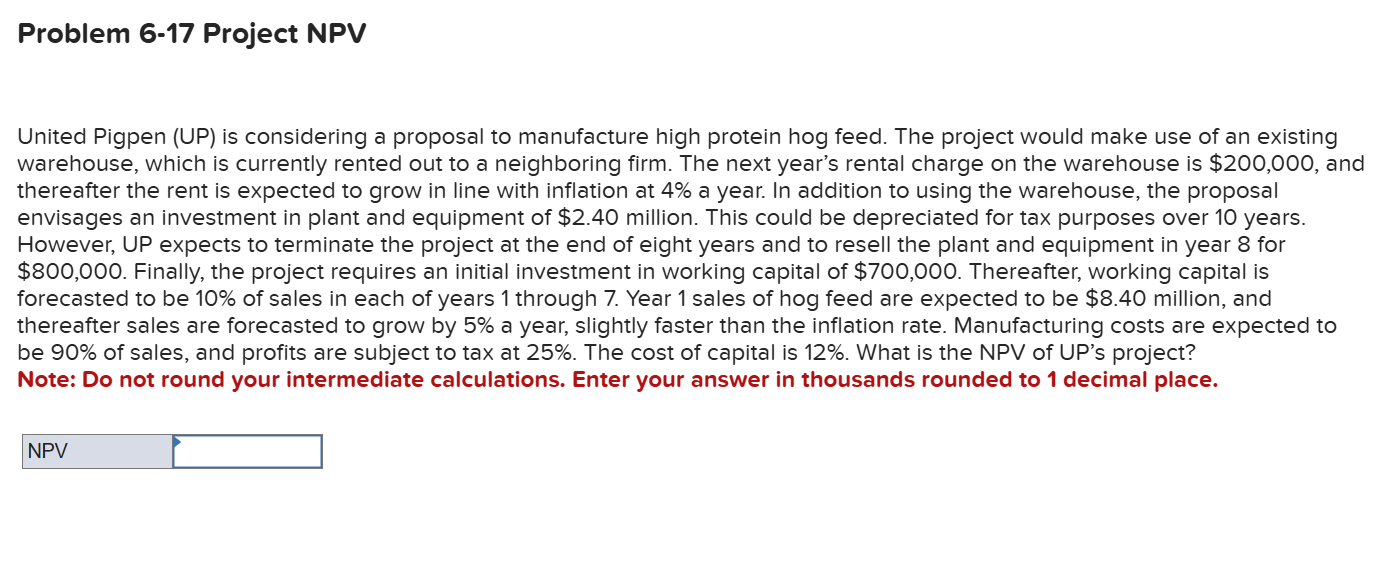

United Pigpen UP is considering a proposal to manufacture high protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $ and thereafter the rent is expected to grow in line with inflation at a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $ million. This could be depreciated for tax purposes over years. However, UP expects to terminate the project at the end of eight years and to resell the plant and equipment in year for $ Finally, the project requires an initial investment in working capital of $ Thereafter, working capital is forecasted to be of sales in each of years through Year sales of hog feed are expected to be $ million, and thereafter sales are forecasted to grow by a year, slightly faster than the inflation rate. Manufacturing costs are expected to be of sales, and profits are subject to tax at The cost of capital is What is the NPV of UP's project?

Note: Do not round your intermediate calculations. Enter your answer in thousands rounded to decimal place.

NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock