Question: PROBLEM 6 ( 1 8 Points ) Let's say you purchase an AAA - rated, 9 % coupon, 2 0 - year maturity, $ 1

PROBLEM Points

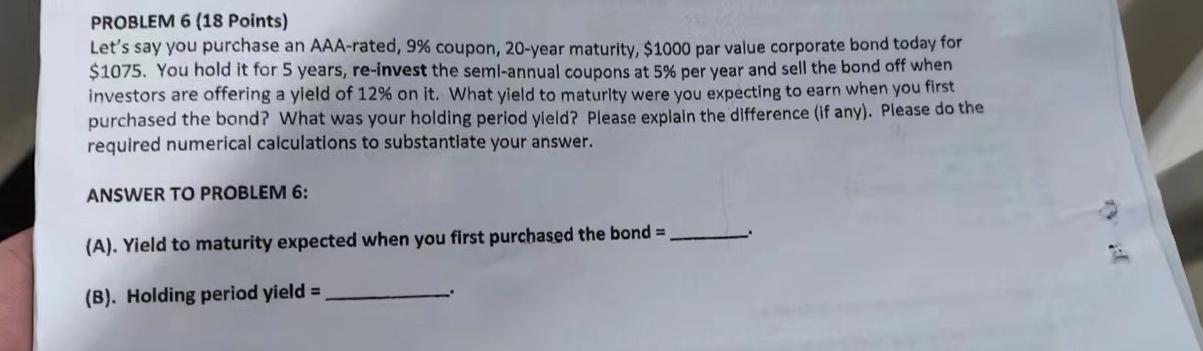

Let's say you purchase an AAArated, coupon, year maturity, $ par value corporate bond today for $ You hold it for years, reinvest the semlannual coupons at per year and sell the bond off when investors are offering a yleld of on it What yield to maturity were you expecting to earn when you first purchased the bond? What was your holding period yleld? Please explain the difference if any Please do the required numerical calculations to substantiate your answer.

ANSWER TO PROBLEM :

A Yield to maturity expected when you first purchased the bond

B Holding period yield

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock