Question: Problem 6 (10 points) a) Company A plans to pay a $0.25 dividend in one year, and grow that dividend at 15% per year for

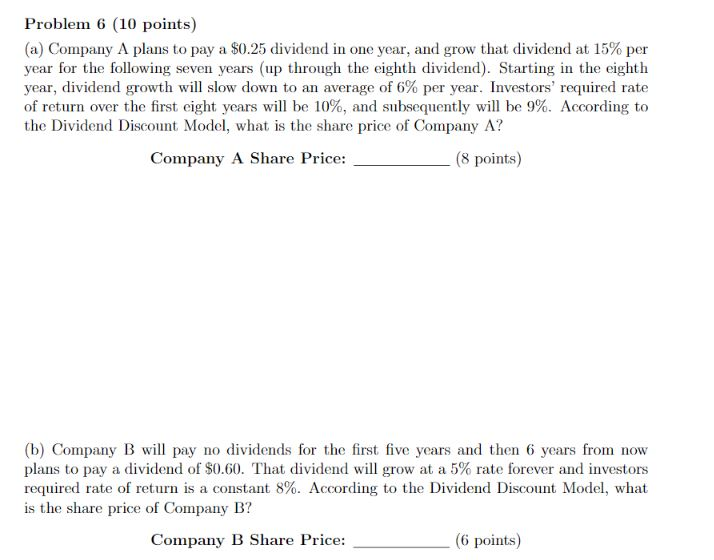

Problem 6 (10 points) a) Company A plans to pay a $0.25 dividend in one year, and grow that dividend at 15% per year for the following seven years (up through the eighth dividend). Starting in the eighth year, dividend growth will slow down to an average of 6% per year. Investors' required rate of return over the first eight years will be 10%, and subsequently will be 9%. According to the Dividend Discount Model, what is the share price of Company A? Company A Share Price: (8 points (b) Company B will pay no dividends for the first five years and then 6 years from now plans to pay a dividend of $0.60. That dividend will grow at a 5% rate forever and investors required rate of return is a constant 8%. According to the Dividend Discount Model, what is the share price of Company B? Company B Share Price: (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts